Last Updated on: 22nd July 2025, 04:24 pm

Contents

- 1 Unveiling the Gateway to India’s Financial Future: An Introduction to GIFT City

- 2 Understanding the Regulatory Landscape in Gift City

- 3 Demystifying the Regulatory Structure in GIFT City

- 4 Legal Framework and Taxation: A Boon for Businesses and Investors

- 5 Unveiling Investment Gems in GIFT City: A Gateway to India’s Financial Future

- 6 Conclusion: Unveiling a Gateway to Financial Growth

Unveiling the Gateway to India’s Financial Future: An Introduction to GIFT City

The world of finance is constantly evolving, seeking new hubs to foster innovation and growth. In India, a shining beacon has emerged: Gujarat International Finance Tec-City (GIFT City). This meticulously planned city within a city, situated in Gujarat, is rapidly transforming into a global financial powerhouse. But what exactly is GIFT City, and why is it capturing the attention of businesses and investors worldwide?

GIFT City is more than just a financial center; it’s a strategic vision brought to life. As India’s first operational smart city, it boasts state-of-the-art infrastructure, a world-class business environment, and a strategic location. Imagine a hub designed to rival established financial giants like Singapore, Dubai, and Hong Kong. That’s the ambition behind GIFT City, and it’s attracting a wealth of opportunities for businesses and investors.

Here’s what truly sets GIFT City apart:

- Unparalleled Access to a Booming Market: GIFT City offers a gateway to India’s vast and dynamic market, a land of immense potential for financial growth.

- Special Economic Zone (SEZ) Advantages: Operating within a SEZ grants businesses a multitude of incentives, including tax exemptions, making it a highly attractive location for establishing a presence in India.

- Robust Regulatory Framework: GIFT City prioritizes transparency and stability through a well-defined legal framework and a dedicated set of regulatory authorities, fostering an environment conducive to secure and successful investment.

GIFT City is more than just a financial center; it’s a springboard for propelling businesses and investors into the heart of India’s thriving financial landscape. As we delve deeper into this blog, we’ll explore the intricacies of GIFT City’s regulatory framework, the unique investment opportunities it offers, and the reasons why it’s poised to become a game-changer in the global financial arena.

Understanding the Regulatory Landscape in Gift City

Gift City operates within a unique regulatory framework designed to foster innovation and growth. While navigating this landscape might seem complex at first glance, understanding the key regulatory authorities and their roles is crucial for a smooth operation within Gift City. Here’s a breakdown of the prominent entities that govern various aspects of financial activities in Gift City:

- Gujarat International Finance Tec-City Authority (GIFT):

GIFT serves as the governing body for Gift City, overseeing its overall functioning and development. It ensures Gift City adheres to international best practices while maintaining its status as a tax-efficient jurisdiction. - International Financial Services Centre Authority (IFSCA):

Established specifically for Gift City, IFSCA is the primary regulator for financial institutions, financial products, and financial services. Its focus areas include banking, capital markets, insurance, and allied activities. Notably, the regulatory powers of RBI, SEBI, IRDAI, and PFRDA have been vested in IFSCA for regulating these financial activities within Gift City.

Demystifying the Regulatory Structure in GIFT City

Gift City Regulations of Gujarat International Finance Tech-City Authority

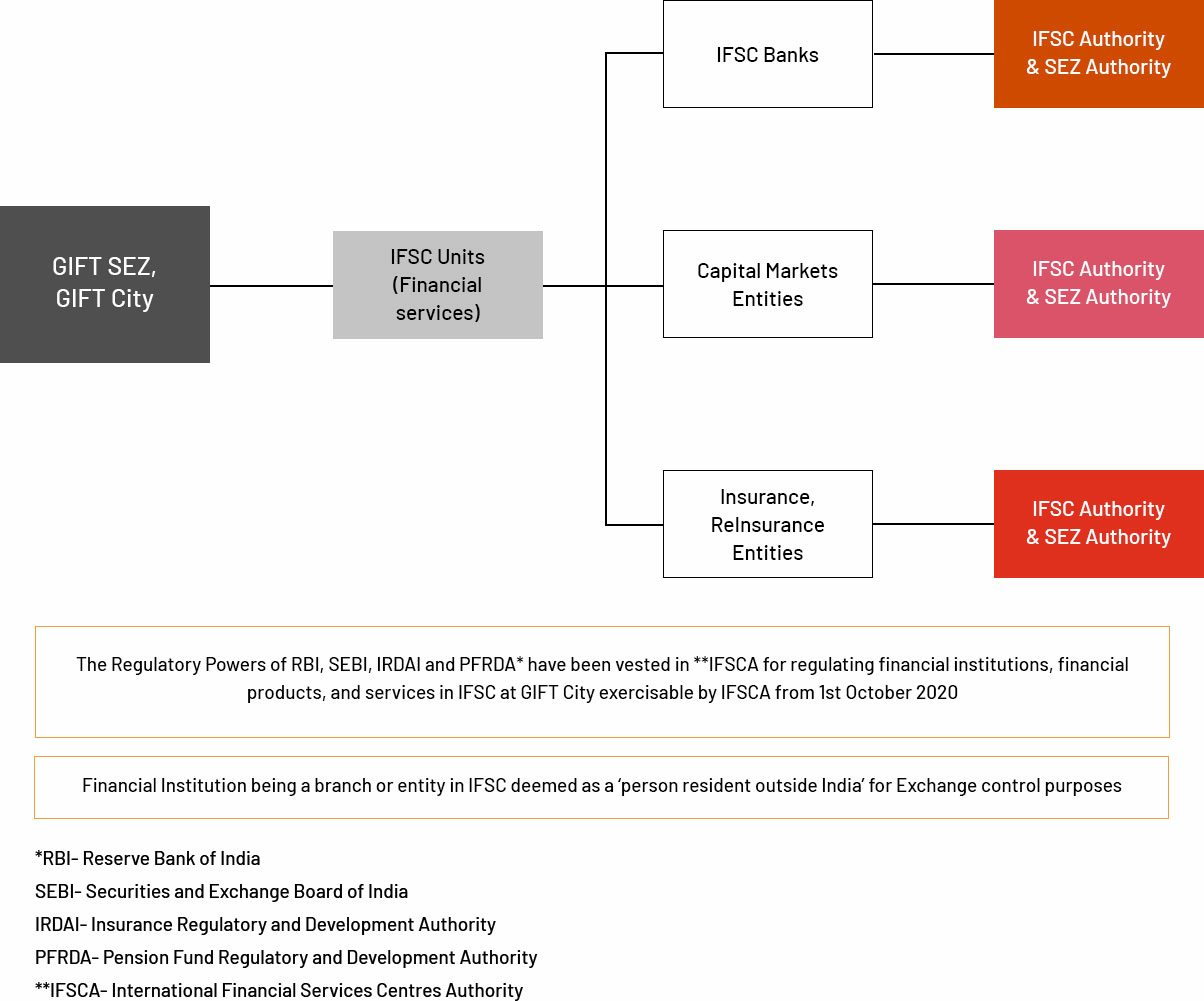

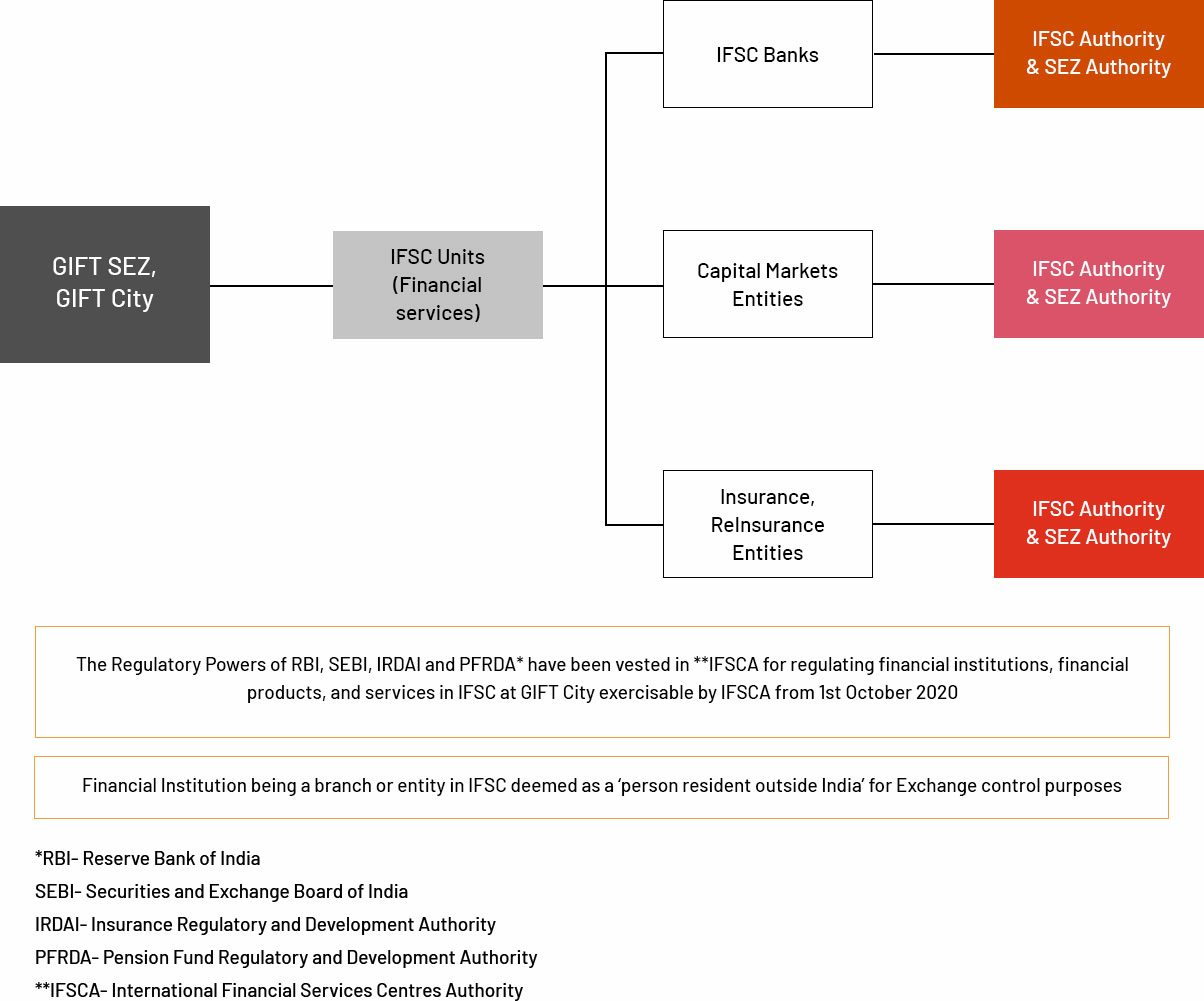

The image depicts a simplified view of the regulatory structure within Gift City. It highlights the following key points:

- IFSCA is the single authority overseeing financial institutions, financial services, and capital market activities within Gift City.

- SEZ Units (Special Economic Zone Units) and IFSC Units (International Financial Services Centre Units) fall under the purview of IFSCA.

- Insurance and reinsurance entities operating in Gift City are also regulated by IFSCA.

It’s important to note that while IFSCA is the primary regulator, the underlying framework incorporates the expertise of established authorities like SEBI, RBI, and IRDAI. This ensures a comprehensive and robust regulatory structure for Gift City.

Legal Framework and Taxation: A Boon for Businesses and Investors

Gift City operates under a robust legal framework that, coupled with a favorable tax regime, fosters a highly attractive environment for businesses and investors. Here’s a closer look at these advantages:

Legal Framework:

- Common Law System: Gift City adheres to a common law system (IFSCA framework), known for its clarity, predictability, and established body of case law. This provides a familiar and reliable legal foundation for businesses accustomed to similar systems.

- Business-Friendly Environment: The legal structure within Gift City is designed to streamline operations and minimize bureaucratic hurdles. This allows businesses to focus on growth and innovation.

- Dispute Resolution: Gift City boasts a world-class dispute resolution mechanism. The Singapore International Arbitration Centre (SIAC) has opened its second representative office in India in the International Financial Services Centre (GIFT IFSC) in GIFT, Gujarat, to assist in the promotion of international commercial arbitration.

Taxation Benefits:

- Income Tax Exemptions: Businesses and individuals operating within Gift City enjoy income tax exemptions for a specified period. The exact duration of the exemption can vary depending on the type of unit being set up and the commencement of operations. Here’s a general breakdown:

- 100% income tax exemption for 10 consecutive years out of the first 15 years for units established in International Financial Services Centre (IFSC).

- Companies opting for the new tax regime may not be eligible for the full 10-year exemption but can benefit from lower tax rates.

- Goods and Services Tax (GST): Gift City follows a unique GST regime that provides certain exemptions and benefits. These benefits can simplify the taxation process and reduce the overall tax liability for businesses. It’s important to consult with a tax professional to understand the specific exemptions and how they apply to your business activities.

- Stamp Duty Exemptions: Stamp duty, a tax levied on certain financial transactions, is waived for transactions conducted within Gift City. This can result in significant cost savings, particularly for businesses engaged in capital market activities such as buying and selling shares.

Unveiling Investment Gems in GIFT City: A Gateway to India’s Financial Future

GIFT City, India’s international financial hub, has emerged as a game-changer, attracting investors with its strategic location, robust regulatory framework, and a treasure trove of investment opportunities. Here, we explore some of the most valuable gems waiting to be discovered:

International Financial Services: Your Gateway to India’s Growth Story

- Banking Powerhouse: Foreign banks can set up shop in GIFT City, becoming a bridge for seamless cross-border transactions and catering to the burgeoning needs of the Indian market. This presents a unique opportunity to tap into India’s economic rise.

- Insurance Innovation Hub: The insurance sector in GIFT City welcomes foreign players, fostering a more competitive landscape. This translates to a wider range of insurance products and services for Indian consumers, ultimately leading to greater financial security.

- Asset Management Expertise: Investment management firms can leverage GIFT City’s platform to launch innovative products targeting both domestic and international investors. This allows them to participate in India’s growing pool of investable assets and propel the nation’s financial engine.

Unveiling the Power of Commodities and Derivatives

- Global Benchmarking: The exchange adheres to stringent international standards, ensuring transparent price discovery and fostering trust among investors.

- Diversification Arsenal: From commodities and derivatives to precious metals, the exchange offers a vast array of products, empowering investors to build well-diversified portfolios and manage risk effectively.

- Tech-Driven Trading Advantage: The exchange utilizes cutting-edge technology, providing a robust and secure platform for smooth and efficient trading experiences.

Alternative Investment Funds (AIFs): Unlocking New Investment Avenues

GIFT City provides a fertile ground for the establishment and operation of AIFs, catering to sophisticated investors seeking alternatives to traditional stocks and bonds. Here are some of the AIF categories that flourish within GIFT City:

- Private Equity Powerhouse: Private equity funds can raise capital from a global pool of investors and channel it towards promising Indian companies, fueling their growth and driving innovation.

- Venture Capital Catalyst: Venture capital funds can leverage GIFT City’s platform to invest in high-potential Indian startups and early-stage businesses, fostering a vibrant entrepreneurial ecosystem.

Remember, Due Diligence is Key

Before embarking on any investment journey, thorough due diligence is paramount. Consult with qualified financial advisors who can assess your risk tolerance and investment goals, guiding you towards the most suitable opportunities within GIFT City. Additionally, a comprehensive understanding of the specific regulations and requirements for each investment category is essential to navigate GIFT City’s financial ecosystem successfully.

By harnessing the unique advantages offered by GIFT City, investors can unlock a treasure trove of possibilities and actively participate in India’s dynamic and exciting financial future. So, dive in, explore the investment gems within GIFT City, and become a part of India’s growth story!

Conclusion: Unveiling a Gateway to Financial Growth

GIFT City’s emergence as a global financial hub presents a compelling proposition for investors seeking a dynamic and lucrative environment. Here’s a recap of the key benefits that make GIFT City an attractive investment destination:

- Robust Regulatory Framework: A well-defined legal structure and a dedicated regulatory authority (IFSCA) ensure transparency, stability, and adherence to international best practices. This fosters investor confidence and mitigates risk.

- Tax Advantages: Significant income tax exemptions, a beneficial GST regime, and stamp duty waivers translate to substantial cost savings for businesses and investors. This enhances profitability and incentivizes investment.

- Access to a Booming Market: GIFT City provides a gateway to India’s vast and growing economy. Investors can leverage this platform to tap into a multitude of opportunities across various sectors.

- Diversified Investment Avenues: From international financial services and commodity trading to alternative investment funds, GIFT City offers a wide spectrum of investment options. This allows investors to create well-diversified portfolios and manage risk effectively.

- World-Class Infrastructure: GIFT City boasts state-of-the-art infrastructure, including advanced technology platforms and a business-friendly ecosystem. This facilitates smooth operations and fosters innovation.

The Future of GIFT City: A Vision of Growth

GIFT City’s future is brimming with potential. Here are some exciting possibilities on the horizon:

- Enhanced Connectivity: As infrastructure projects like dedicated high-speed rail and improved air linkages materialize, GIFT City’s global accessibility will be further strengthened, attracting a wider pool of investors and businesses.

- Financial Innovation Hub: GIFT City is poised to become a breeding ground for financial innovation. Regulatory authorities are actively working to facilitate the development of new financial products and services, keeping pace with the evolving global financial landscape.

- Talent Magnet: With its focus on attracting skilled professionals, GIFT City is well on its way to becoming a global talent hub. This will create a dynamic ecosystem that fosters collaboration, knowledge sharing, and continuous growth.

Investing in GIFT City is akin to investing in the future of finance. By capitalizing on its unique advantages and staying abreast of its evolving landscape, investors can unlock a world of possibilities and become part of India’s remarkable growth story.

We Are Problem Solvers. And Take Accountability.

Related Posts

AIF in GIFT City IFSC- Structures, Regulations, Benefits

AI Summary The growth of Alternative Investment Funds (AIFs) in…

Learn More

GIFT City Business Opportunities – A Deep Exploration

AI Summary GIFT City (Gujarat International Finance Tec-City) is India’s…

Learn More

GIFT City Ecosystem for Startups – A Complete Guide in 2026

AI Summary GIFT City, India's first International Financial Services Centre…

Learn More