GIFT International Financial Services Centre

centre at GIFT City.

What is IFSCA?

The International Financial Services Centres Authority (IFSCA) has been established on April 27, 2020 under the International Financial Services Centres Authority Act, 2019. It is headquartered at GIFT City, Gandhinagar in Gujarat.

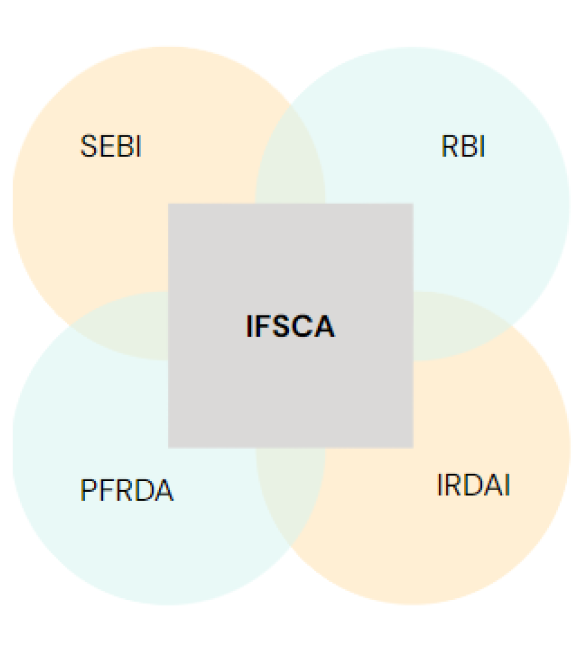

The IFSCA is a unified regulator comprising RBI, SEBI, PFRDA, and IRDAI and is responsible for the development and regulation of financial products and services in the IFSC in India. At present, the GIFT IFSC is the maiden international financial services centre in India.

IFSC Journey

2014

GIFT City notified as SEZ for international financial services

2015

Ministry of Finance notifies India’s first IFSC

2016

Union Budget provided a competitive tax regime for units in IFSC

2018

RBI notifies IFSC as non-resident zone

2020

IFSC Authority (IFSCA) was established

2022

IFSCA notified key regulations, circulars, notifications

2024

Area expansion from 886 acres to over 3,300 acres

IFSC Highlights

Setting up Process

Identify Use Case

Discussion with our team, meeting with IFSCA & GIFT officials to demonstrate the business use case for GIFT IFSC

Application to IFSCA

Identify office space and make application with regulators

Approval & Payment of Fees

Submit post approval documentation along with fees, open bank accounts and apply for business and tax registrations

Kickstart your Business

Obtain final IFSCA approval and start operations

Interested to setting up your business in GIFT IFSC?

Frequently Asked Questions

Fintech: This refers to emerging financial technologies and innovations that drive new business models, applications, processes, or products in areas connected to financial services. These are typically B2C in nature.

𝘍𝘰𝘳 𝘦𝘹𝘢𝘮𝘱𝘭𝘦 – 𝘗𝘢𝘺𝘵𝘮, 𝘊𝘳𝘦𝘥, 𝘙𝘢𝘻𝘰𝘳𝘱𝘢𝘺, 𝘗𝘰𝘭𝘪𝘤𝘺𝘣𝘢𝘻𝘢𝘢𝘳, 𝘗𝘪𝘯𝘦𝘭𝘢𝘣𝘴, 𝘚𝘭𝘪𝘤𝘦, 𝘦𝘵𝘤

Techfin: These are advanced or innovative technological solutions primarily designed to support, aid, and enhance activities related to financial products, services, and institutions. These are typically B2B in nature where they have tech products which can be used by financial institutions for their operations.

𝘍𝘰𝘳 𝘦𝘹𝘢𝘮𝘱𝘭𝘦 – 𝘍𝘪𝘯𝘢𝘤𝘭𝘦 (𝘣𝘺 𝘐𝘯𝘧𝘰𝘴𝘺𝘴), 𝘔𝘢𝘮𝘣𝘶, 𝘉𝘳𝘰𝘬𝘦𝘳𝘌𝘥𝘨𝘦, 𝘐𝘯𝘴𝘶𝘳𝘦𝘊𝘙𝘔, 𝘖𝘋𝘐𝘕, 𝘦𝘵𝘤