What is IFSCA?

The International Financial Services Centres Authority (IFSCA) has been established on April 27, 2020 under the International Financial Services Centres Authority Act, 2019. It is headquartered at GIFT City, Gandhinagar in Gujarat.

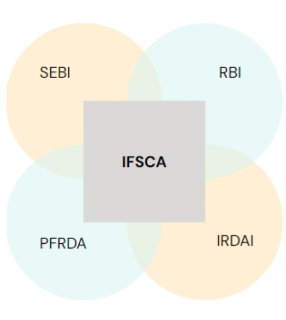

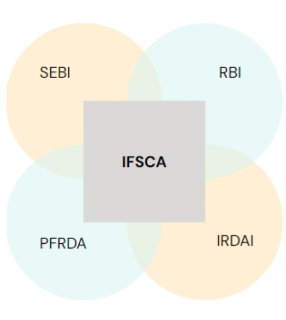

The IFSCA is a unified regulator comprising RBI, SEBI, PFRDA, and IRDAI and is responsible for the development and regulation of financial products and services in the IFSC in India. At present, the GIFT IFSC is the maiden international financial services centre in India. The International Financial Services Centres Authority (IFSCA) has been established on April 27, 2020 under the International Financial Services Centres Authority Act, 2019. It is headquartered at GIFT City, Gandhinagar in Gujarat.

IFSC Highlights

-

- 28Banks

- 140Capital Markets Intermediaries

- 2International Stock Exchanges

- 159Aircraft Leasing Firms

- 113Fintech Entities

-

- 38Insurance & Reinsurance Firms

- 157Alternative Investment Funds

- 2Foreign Universities

- 12Ship Leasing Firms

- 22International Bullion Exchange & Bullion Vaults

Setting up Process

Identify Use Case

Discussion with our team, meeting with IFSCA & GIFT officials to demonstrate the business use case for GIFT IFSC

Application to IFSCA

Identify office space and make application with regulators for entity setup or unit setup

Approval & Payment of Fees

Submit post approval documentation along with fees, open bank accounts and apply for business and tax registrations

Kickstart your Business

Obtain final IFSCA approval and start operations

Are you looking to set up your office at GIFT City?

Connect with us

Jitesh Agarwal

Founder

jitesh@treelife.in

Leads the VCFO, finance tax, and regulatory functions at Treelife. Responsible for the firm’s non-operational growth and providing strategic advisory in GIFT City, helping clients navigate complex regulatory landscapes effectively.

Priya Kapasi Shah

Associate Partner | Tax & Regulatory

priya.k@treelife.in

Heads Treelife’s Financial Advisory practice, specializing in investment structuring, cross-border transactions, and tax and regulatory advisory. Also leads on AIF setups and advisory services for GIFT IFSC.

Dhairya Chaniyara

Senior Associate | Financial Advisory

dhairya.c@treelife.in

Focuses on direct tax and regulatory services with a specialization in GIFT IFSC. Brings experience from various industries, including manufacturing, FMCG, IT-ITES, and healthcare, to deliver impactful tax solutions.

Frequently Asked Questions

Who are the real estate developers in GIFT City?

There are multiple real estate developers offering office space in GIFT City. There are also a few Plug N Play service providers in GIFT City. Refer here for more details – https://www.giftgujarat.in/business/ifsc

What is the difference between fintech and techfin under the GIFT IFSC framework?

Fintech: This refers to emerging financial technologies and innovations that drive new business models, applications, processes, or products in areas connected to financial services. These are typically B2C in nature.

𝘍𝘰𝘳 𝘦𝘹𝘢𝘮𝘱𝘭𝘦 – 𝘗𝘢𝘺𝘵𝘮, 𝘊𝘳𝘦𝘥, 𝘙𝘢𝘻𝘰𝘳𝘱𝘢𝘺, 𝘗𝘰𝘭𝘪𝘤𝘺𝘣𝘢𝘻𝘢𝘢𝘳, 𝘗𝘪𝘯𝘦𝘭𝘢𝘣𝘴, 𝘚𝘭𝘪𝘤𝘦, 𝘦𝘵𝘤.

Techfin: These are advanced or innovative technological solutions primarily designed to support, aid, and enhance activities related to financial products, services, and institutions. These are typically B2B in nature where they have tech products which can be used by financial institutions for their operations.

𝘍𝘰𝘳 𝘦𝘹𝘢𝘮𝘱𝘭𝘦 – 𝘍𝘪𝘯𝘢𝘤𝘭𝘦 (𝘣𝘺 𝘐𝘯𝘧𝘰𝘴𝘺𝘴), 𝘔𝘢𝘮𝘣𝘶, 𝘉𝘳𝘰𝘬𝘦𝘳𝘌𝘥𝘨𝘦, 𝘐𝘯𝘴𝘶𝘳𝘦𝘊𝘙𝘔, 𝘖𝘋𝘐𝘕, 𝘦𝘵𝘤.

Is the AIF regulated by GIFT IFSC?

Unlike SEBI’s domestic AIF regulations where the fund (AIF) seeks registration with SEBI, under the IFSCA regulations, the fund management entity (FME) seeks registration with the IFSCA and can launch funds (schemes) with only prior intimation to IFSCA.

How many approvals does one need to obtain to operate in GIFT IFSC?

As of now, approval is needed from the SEZ authorities and the IFSCA authorities for operating in GIFT IFSC. A proposal to make a single window clearance in underway.

Are entities in GIFT IFSC treated as a resident in India?

From an Income-tax perspective, entities in GIFT IFSC are “resident” in India while from an exchange control perspective, entities in GIFT IFSC are “non-resident”.

How does GIFT City’s IFSC compare with other global financial hubs?

GIFT City’s IFSC is strategically designed to offer services at par with global financial hubs. Its state-of-the-art infrastructure, streamlined regulatory framework, and competitive advantages position it as a leading financial center in the Asian market.

What kind of tax incentives does GIFT City’s IFSC offer?

Companies in GIFT City’s IFSC enjoy various tax benefits, including lower tax rates, exemptions from several duties, and other incentives aimed at promoting the ease of doing business.

Are there special regulatory provisions for businesses in GIFT City’s IFSC?

Yes, businesses in GIFT City’s IFSC are governed by a separate regulatory framework crafted by the IFSC Authority, ensuring a competitive and friendly business environment while maintaining international standards.

Why should a business set up its operations in the GIFT City IFSC?

Entities in GIFT City’s IFSC benefit from a favorable regulatory environment, tax incentives, robust infrastructure, and easy access to a massive global market, making it a strategic location for financial service providers.

Who are the real estate developers in GIFT City?

There are multiple real estate developers offering office space in GIFT City. There are also a few Plug N Play service providers in GIFT City. Refer here for more details – https://www.giftgujarat.in/business/ifsc

What is the difference between fintech and techfin under the GIFT IFSC framework?

Fintech: This refers to emerging financial technologies and innovations that drive new business models, applications, processes, or products in areas connected to financial services. These are typically B2C in nature.

𝘍𝘰𝘳 𝘦𝘹𝘢𝘮𝘱𝘭𝘦 – 𝘗𝘢𝘺𝘵𝘮, 𝘊𝘳𝘦𝘥, 𝘙𝘢𝘻𝘰𝘳𝘱𝘢𝘺, 𝘗𝘰𝘭𝘪𝘤𝘺𝘣𝘢𝘻𝘢𝘢𝘳, 𝘗𝘪𝘯𝘦𝘭𝘢𝘣𝘴, 𝘚𝘭𝘪𝘤𝘦, 𝘦𝘵𝘤.

Techfin: These are advanced or innovative technological solutions primarily designed to support, aid, and enhance activities related to financial products, services, and institutions. These are typically B2B in nature where they have tech products which can be used by financial institutions for their operations.

𝘍𝘰𝘳 𝘦𝘹𝘢𝘮𝘱𝘭𝘦 – 𝘍𝘪𝘯𝘢𝘤𝘭𝘦 (𝘣𝘺 𝘐𝘯𝘧𝘰𝘴𝘺𝘴), 𝘔𝘢𝘮𝘣𝘶, 𝘉𝘳𝘰𝘬𝘦𝘳𝘌𝘥𝘨𝘦, 𝘐𝘯𝘴𝘶𝘳𝘦𝘊𝘙𝘔, 𝘖𝘋𝘐𝘕, 𝘦𝘵𝘤.

Is the AIF regulated by GIFT IFSC?

Unlike SEBI’s domestic AIF regulations where the fund (AIF) seeks registration with SEBI, under the IFSCA regulations, the fund management entity (FME) seeks registration with the IFSCA and can launch funds (schemes) with only prior intimation to IFSCA.

How many approvals does one need to obtain to operate in GIFT IFSC?

As of now, approval is needed from the SEZ authorities and the IFSCA authorities for operating in GIFT IFSC. A proposal to make a single window clearance in underway.

Are entities in GIFT IFSC treated as a resident in India?

From an Income-tax perspective, entities in GIFT IFSC are “resident” in India while from an exchange control perspective, entities in GIFT IFSC are “non-resident”.