AI Summary

Aircraft leasing in GIFT City is transforming India's aviation finance by offering tax incentives and global-standard regulations, rivaling hubs like Ireland and Singapore. With favorable IFSCA regulations, it provides a gateway for aircraft finance, attracting both domestic and international lessors. GIFT City facilitates both operating and finance leases, reducing reliance on foreign jurisdictions and aligning with international conventions, offering airlines and investors a cost-efficient platform. Leasing transactions surged by 30% in 2024, with 20+ registered lessors by 2025. India's projected demand for 2,000 aircraft by 2040 positions GIFT IFSC as Asia's aviation finance hub. The government aims for 25% of India's leasing through GIFT City by 2030, potentially attracting USD 5-10 billion annually. GIFT City is set to drive long-term growth in the aviation sector.

Last Updated on: 7th October 2025, 05:25 pm

Contents

- 1 Introduction

- 2 What is Aircraft Leasing & Financing?

- 3 Why GIFT City for Aircraft Leasing & Financing?

- 4 Net-Worth Requirements for Aircraft Leasing Entities in GIFT City

- 5 The IFSCA Aircraft Leasing Framework (2022)

- 6 Recent Growth & Market Trends in Aircraft Leasing at GIFT City

- 7 Legal & Regulatory Ecosystem for Aircraft Leasing in GIFT City

- 8 Taxation & Incentives for Aircraft Leasing in GIFT City

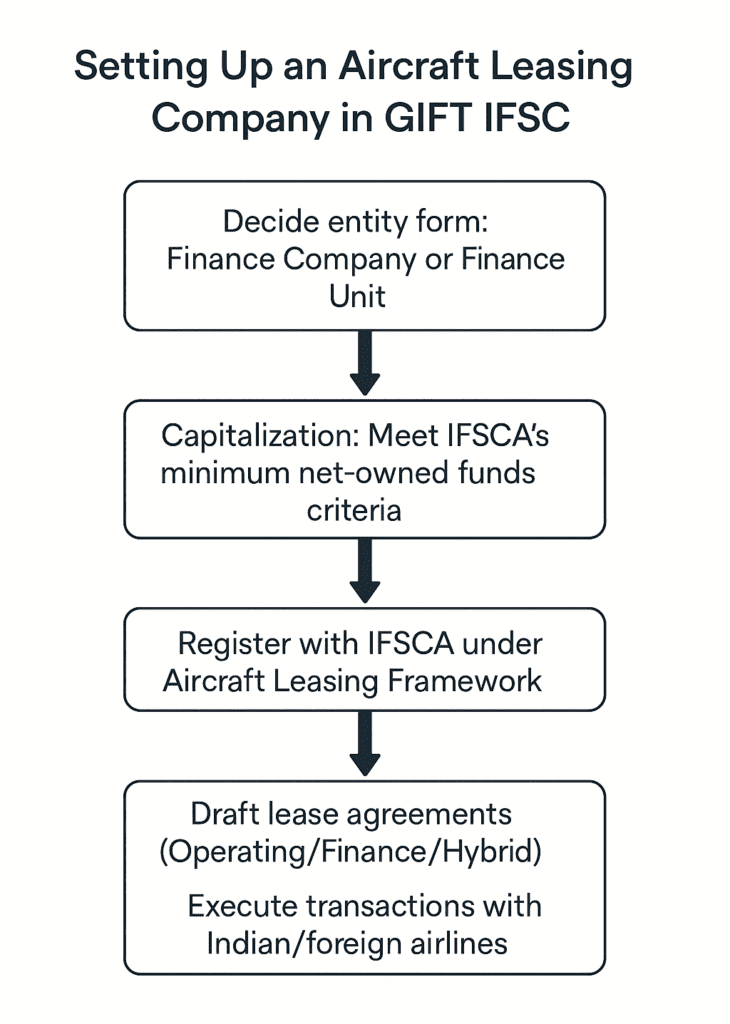

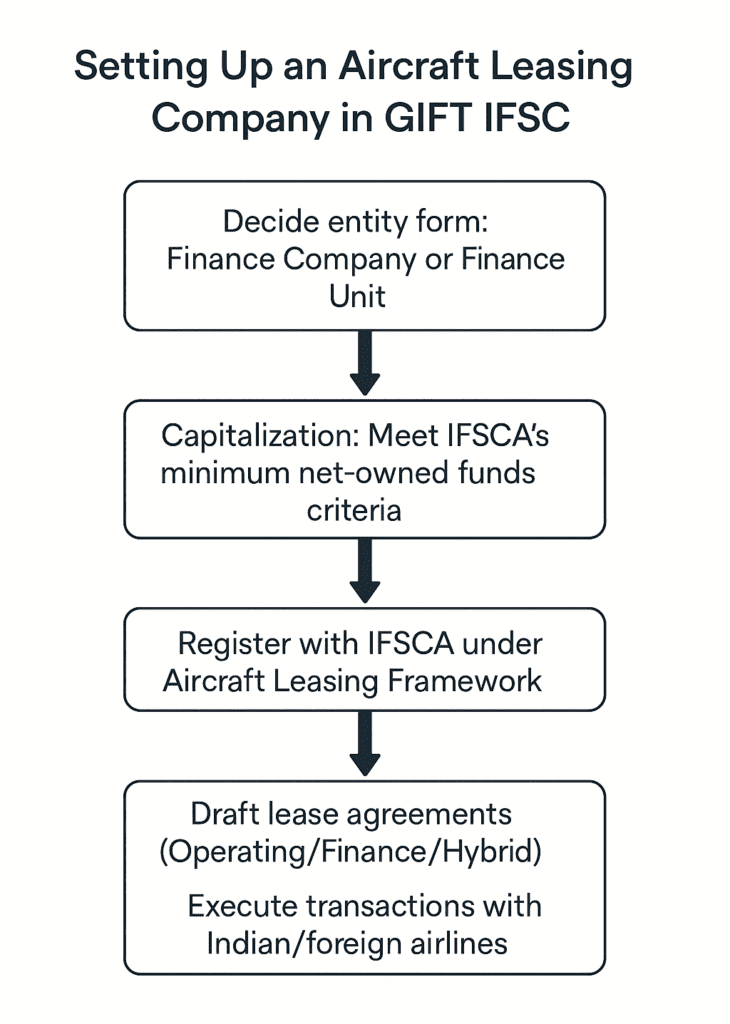

- 9 Setting Up an Aircraft Leasing Company in GIFT IFSC

- 9.1 Step-by-Step Process to Establish a Leasing Business

- 9.1.1 1. Choose Entity Structure: Finance Company (FC) or Finance Unit (FU)

- 9.1.2 2. Meet Capitalization Requirements

- 9.1.3 3. Register with IFSCA under the Aircraft Leasing Framework, 2022 as amended from time to time

- 9.1.4 4. Draft Lease Agreements

- 9.1.5 5. Obtain DGCA and MoCA Approvals (if required)

- 9.1.6 6. Execute Leasing Transactions

- 9.2 Comprehensive Checklist for Lessors in GIFT IFSC

- 9.3 Strategic Advantages for Lessors

- 9.4 Long-Term Considerations

- 9.1 Step-by-Step Process to Establish a Leasing Business

- 10 IFSCA Registration and Licensing Fees

- 11 SEZ & GIFT City Authority Charges

- 12 Opportunities & Challenges in Aircraft Leasing at GIFT City

- 13 Future Outlook for Aviation Finance in GIFT City

Introduction

Aircraft Leasing in GIFT City – A New Era for Aviation Finance

Aircraft leasing in GIFT City has become a game-changer for India’s aviation sector. With the majority of Indian airlines traditionally depending on global hubs like Ireland and Singapore for aircraft finance, the creation of a dedicated framework at GIFT IFSC provides a domestic alternative that offers both cost efficiency and regulatory clarity.

Significance for India’s Aviation Growth

- India is currently the third-largest domestic aviation market and is on track to become the third-largest overall aviation market by 2030.

- Fleet expansion is inevitable: industry forecasts suggest 1,500–2,000 new aircraft will be required by 2040 to meet passenger growth.1

- A local hub for aircraft finance in GIFT City reduces dependency on foreign lessors, lowers leasing costs, and creates an ecosystem for investors, airlines, and financiers.

Why GIFT IFSC as a Global Hub

- Tax Incentives: Units enjoy a 10-year tax holiday within a 15-year block, exemption from GST, and reduced withholding taxes.

- Ease of Doing Business: Single-window approvals and globally aligned IFSCA regulations make it simpler for lessors and financiers to set up operations.

- Strategic Location: Positioned in Gujarat International Finance Tec-City (GIFT), it offers infrastructure on par with leading global financial hubs.

Rising Momentum in Aircraft and Engine Leasing

- According to industry data, aircraft and engine leasing transactions at GIFT City rose by 30% in 2024 year-on-year.

- Growing participation of aircraft leasing companies signals a shift in aviation finance in GIFT City, with international and domestic players leveraging the operating lease of aircrafts and finance lease of aircrafts structures to serve Indian airlines more effectively.

What is Aircraft Leasing & Financing?

Aircraft leasing and financing are the backbone of modern aviation, enabling airlines to expand fleets without heavy upfront capital. For India, where rapid air travel growth demands thousands of new aircraft, aircraft leasing in GIFT City provides a strategic domestic solution.

Types of Aircraft Leases

Operating Lease of Aircrafts

- Short to medium-term arrangement (typically 3–10 years).

- Ownership remains with the lessor; the airline only pays for use.

- Allows flexibility for airlines to return or replace aircraft at lease-end.

- Commonly used by low-cost carriers expanding capacity without long-term commitments.

Finance Lease of Aircrafts

- Long-term lease (often covering most of the aircraft’s useful life).

- Treated as an asset purchase with financing; lessee assumes risks and rewards of ownership.

- Useful for full-service carriers planning to retain aircraft longer.

Comparison Table: Operating Lease vs Finance Lease

| Feature | Operating Lease of Aircrafts | Finance Lease of Aircrafts |

| Ownership | Lessor retains | Lessee effectively owns |

| Duration | 3–10 years | 10–20 years |

| Balance Sheet Impact | Off-balance sheet | On-balance sheet (capital asset) |

| Risk | Lessor bears | Lessee bears |

| Flexibility | High (easy replacement) | Low (long-term commitment) |

Size of the Global Aviation Finance Market

- The global aircraft leasing industry is valued at USD 300+ billion.

- Over 50% of the world’s commercial fleet is leased rather than owned outright.

- Major hubs: Ireland, Singapore, Hong Kong – but India is building its alternative in GIFT IFSC.

Why India Needs Aviation Finance in GIFT City

- Dependency on Foreign Lessors: More than 80% of India’s commercial fleet is currently leased through Ireland and Singapore.

- This leads to higher costs, exposure to foreign tax regimes, and limited domestic control.

- Establishing a strong aviation finance ecosystem in GIFT City ensures:

- Lower leasing costs for Indian airlines.

- Retention of financing profits within India.

- Improved access for domestic investors and financiers.

- Greater legal and regulatory control aligned with Indian aviation policy.

Why GIFT City for Aircraft Leasing & Financing?

GIFT IFSC has emerged as India’s answer to global leasing hubs like Ireland and Singapore. It provides a competitive ecosystem for aircraft leasing companies in GIFT City, combining tax efficiency, regulatory clarity, and ease of operations. For both international and domestic lessors, it offers a strategic gateway to tap into India’s rapidly growing aviation market.

Key Advantages of Setting Up in GIFT City

1. 100% Foreign Ownership Permitted

- International lessors can establish fully-owned entities without local ownership restrictions.

- Encourages global players to directly enter the Indian aviation finance market.

2. Tax Incentives

- 10-year tax holiday available in a 15-year block period.

- Exemption from Minimum Alternate Tax (MAT) for units availing holiday.

- No GST or stamp duty on leasing transactions and related documentation.

- Reduced withholding tax of 3–4% vs ~20% in traditional jurisdictions.

3. Regulatory Clarity

- Governed under the IFSCA (Finance Company) Regulations, 2021 and Aircraft Leasing Framework, 2022 as amended from time to time.

- Clearly defined categories: Operating lease of aircrafts, Finance lease of aircrafts, hybrid structures.

- Streamlined compliance with DGCA and international aviation standards (Cape Town Convention aligned).

4. Ease of Doing Business

- Single-window clearance system for licensing, tax registrations, and approvals.

- Infrastructure and banking ecosystem tailored for global financial services.

- Faster turnaround for setting up and executing leases compared to offshore hubs.

Tax & Regulatory Benefits: GIFT IFSC vs Global Leasing Hubs

| Benefit | GIFT IFSC (India) | Ireland | Singapore |

| Corporate Tax | 10-year holiday (within 15-year block) | 12.5% | 17% |

| Withholding Tax | 0% | ~20% | ~15% |

| GST / Stamp Duty | Exempt subject to certain conditions | Applicable | Applicable |

| Foreign Ownership | 100% allowed | Limited | Limited |

Why This Matters for Aviation Finance in GIFT City

- Lower leasing costs for Indian airlines compared to deals routed through Ireland/Singapore.

- Stronger domestic control over financing structures, reducing dependency on foreign jurisdictions.

- Attractive entry point for global leasing firms exploring the Indian and Asian markets.

- Improved profitability for lessors due to tax savings and exemptions.

In essence, aircraft finance in GIFT City offers international-standard leasing structures at a fraction of the cost of traditional hubs. With its unique mix of tax benefits, 100% foreign ownership, and regulatory clarity, GIFT IFSC is well-positioned to become the preferred destination for both operating leases and finance leases of aircrafts in Asia.

Net-Worth Requirements for Aircraft Leasing Entities in GIFT City

1. Operating Lease Companies (Short- to Medium-Term Leasing)

- Minimum Net-Owned Fund (NOF): USD 200,000 as prescribed by the IFSCA Aircraft Leasing Framework 2022.

- This modest threshold encourages new entrants and startups to participate in aircraft leasing without heavy capital outlay.

- Ideal for Operating Lease Companies (OLCs) that rent aircraft to airlines for 3–10 years, retaining ownership of the aircraft throughout.

- The lighter net-worth requirement supports flexibility, enabling low-cost carriers and smaller lessors to test the market from GIFT City.

2. Finance Lease Companies (Long-Term, Ownership-Linked Leasing)

- Minimum Net-Owned Fund (NOF): USD 3 million, significantly higher to reflect the longer tenure and credit exposure of Finance Lease Companies (FLCs).

- These entities structure leases that transfer substantial ownership benefits to the lessee and often extend over 10–20 years.

- The higher capitalization ensures financial resilience and compliance with prudential norms, enhancing counter-party confidence for both Indian and foreign airlines.

3. Why Net-Worth Norms Matter

- The net-worth criteria act as a financial safeguard ensuring stability of lessors and protecting lessees against under-capitalized operators.

- They also determine the type of activities permitted — e.g., aircraft financing, engine leasing, or sale-and-leaseback structures — under IFSCA supervision.

The IFSCA Aircraft Leasing Framework (2022)

To create a globally competitive ecosystem for aviation finance, the International Financial Services Centres Authority (IFSCA) introduced the Aircraft Leasing Framework in 2022, under the IFSCA (Finance Company) Regulations, 2021. This framework provides legal certainty, structured processes, and favorable conditions for lessors and financiers to operate from GIFT City.

Finance Company (FC) and Finance Unit (FU) Defined

- Finance Company (FC): A company incorporated in GIFT IFSC specifically to undertake aircraft leasing and financing activities.

- Finance Unit (FU): A branch or unit of an existing foreign or Indian entity set up in GIFT City to carry out leasing operations.

This dual structure allows both new entities and global players to participate in India’s leasing ecosystem seamlessly.

Categories of Aircraft Leasing under IFSCA

The framework permits multiple leasing models, offering flexibility to lessors:

- Operating Lease of Aircrafts – Short/medium-term leases with ownership retained by lessor.

- Finance Lease of Aircrafts – Long-term leases structured as financing arrangements.

- Hybrid Leases – Customized structures combining features of both operating and finance leases.

Registration Requirements with IFSCA

- Mandatory registration with IFSCA before commencing leasing activities.

- Submission of application detailing business plan, financials, and compliance framework.

- Approval granted only after meeting capital adequacy and governance standards.

Capital Adequacy Norms

- Entities must maintain minimum net-owned funds (NOF) as prescribed by IFSCA.

- Ensures financial stability and protects airline lessees from under-capitalized lessors.

Permitted Activities under the Framework

Registered Finance Companies (FCs) and Finance Units (FUs) in GIFT City can undertake:

- Leasing of aircraft and helicopters.

- Engine leasing and spare parts leasing.

- Financing of aircraft purchases.

- Transfer of aircraft ownership.

- Ancillary aviation finance services.

Recent Growth & Market Trends in Aircraft Leasing at GIFT City

The aircraft leasing ecosystem in GIFT City has witnessed rapid momentum, making it one of the fastest-growing segments of India’s aviation finance market. With supportive regulation, tax benefits, and rising domestic demand, both international and Indian lessors are increasingly establishing their presence in the International Financial Services Centre (IFSC).

Market Growth Highlights

- 30% year-on-year growth in aircraft and engine leasing transactions recorded in 2024.

- By early 2025, more than 20 aircraft leasing companies in GIFT City had registered with IFSCA.

- Market confidence is reflected in rising participation by both domestic NBFC arms and foreign leasing firms.

India’s Expanding Aircraft Demand

- India is projected to induct 1,500–2,000 new aircraft by 2040, driven by passenger traffic growth and fleet modernization.

- Current fleet: ~700 commercial aircraft (as of 2024), with expected doubling in the next 10 years.

- Leasing will account for a majority of these acquisitions due to lower upfront costs.

Table: India’s Aircraft Fleet Forecast

| Year | Estimated Fleet Size | Share Leased (%) | Key Drivers |

| 2024 | ~700 | 80%+ | Domestic travel boom, foreign leases |

| 2030 | ~1,200 | 75–80% | Low-cost carrier expansion |

| 2040 | ~2,000+ | 70–75% | Replacement + growth demand |

# https://www.civilaviation.gov.in/sites/default/files/2025-03/Annual%20Report%20Civil%20Aviation%20for%20the%20year%202024-25%20English_0.pdf

Domestic Airlines Exploring GIFT IFSC Structures

- IndiGo and Air India are actively evaluating GIFT City leasing models to optimize costs.

- Leasing through GIFT reduces reliance on Ireland/Singapore and allows better alignment with Indian regulations.

- Provides airlines with access to operating leases of aircrafts and finance leases of aircrafts under favorable tax regimes.

Growing Presence of Aircraft Leasing Companies in GIFT City

- International lessors see GIFT as a gateway to the Indian aviation market, given the country’s high growth trajectory.

- Domestic players, including NBFC subsidiaries of major banks, are setting up leasing arms within IFSC.

- This combination creates a balanced ecosystem with both global expertise and local financing support.

The combination of 30% growth in 2024, over 20 registered lessors, and projected demand for 2,000 aircraft by 2040 underscores why aviation finance in GIFT City is gaining traction. By attracting both domestic and global leasing companies, GIFT IFSC is positioning itself as Asia’s next big hub for aircraft leasing and financing.

Legal & Regulatory Ecosystem for Aircraft Leasing in GIFT City

The strength of aircraft leasing in GIFT City lies in its robust legal and regulatory framework. The ecosystem has been designed to provide clarity, international alignment, and investor confidence while ensuring smooth coordination with Indian aviation and financial laws.

IFSCA (Finance Company) Regulations, 2021

- Forms the primary regulatory backbone for finance companies and finance units operating in GIFT IFSC.

- Governs eligibility, licensing, prudential norms, and permitted activities for entities undertaking aircraft finance in GIFT City.

- Provides a single regulatory authority (IFSCA) with powers across financial services, ensuring ease of business and reduced overlap with multiple regulators.

Aircraft Leasing Framework, 2022

- Introduced by IFSCA to specifically cover operating lease of aircrafts, finance lease of aircrafts, and hybrid models.

- Defines registration processes, compliance obligations, and capital adequacy requirements.

- Expands permitted activities to include engine leasing, aircraft transfer, and ancillary aviation financing.

- Brings India’s leasing market closer to global hubs like Ireland and Singapore in terms of regulatory clarity.

Interaction with DGCA and Ministry of Civil Aviation

- Directorate General of Civil Aviation (DGCA): Oversees safety certifications, airworthiness approvals, and aircraft registration in India.

- Ministry of Civil Aviation (MoCA): Provides policy direction, sectoral approvals, and ensures alignment with India’s aviation growth strategy.

- Entities in GIFT City benefit from coordinated clearances between IFSCA, DGCA, and MoCA, reducing compliance delays.

Alignment with Cape Town Convention

- India is a signatory to the Cape Town Convention and Aircraft Protocol, which strengthens international enforcement.

- Provides creditor-friendly repossession rights, crucial for global lessors evaluating jurisdictional risk.

- Enhances confidence for foreign investors and financiers, ensuring lease contracts signed in GIFT IFSC are internationally enforceable.

FEMA & Companies Act Compliance for Indian Lessors

- Leasing structures involving Indian airlines must comply with Foreign Exchange Management Act (FEMA) provisions, particularly for cross-border remittances and payments.

- Entities incorporated as Finance Companies (FCs) or Finance Units (FUs) must adhere to governance and disclosure standards under the Companies Act, 2013.

- Ensures transparency, accounting compliance, and investor protection in leasing transactions.

The legal and regulatory ecosystem in GIFT City integrates IFSCA regulations, DGCA oversight, MoCA policies, Cape Town Convention protections, FEMA, and Companies Act compliance into a unified framework. This alignment provides both domestic and foreign lessors with legal certainty, tax efficiency, and international enforceability, making GIFT IFSC a credible and attractive hub for aviation finance in India.

Taxation & Incentives for Aircraft Leasing in GIFT City

One of the strongest reasons global and domestic lessors are choosing aircraft leasing in GIFT City is its unmatched tax efficiency. GIFT IFSC offers a package of direct tax benefits, indirect tax exemptions, and regulatory incentives that lower overall leasing costs, making India competitive with established hubs like Ireland and Singapore.

Direct Tax Benefits

- 10-year income tax holiday available within a 15-year block for aircraft leasing companies registered in GIFT IFSC.

- Lower effective tax rate improves lease profitability and attracts foreign lessors.

Indirect Tax Incentives

- GST exemption on aircraft and engine leasing transactions conducted within GIFT City.

- Makes leases more cost-effective for Indian airlines, especially compared to offshore structures where GST/VAT is levied.

Other Incentives

- No stamp duty on lease agreements, saving significant transaction costs.

- Customs duty benefits on import and export of aircraft, engines, and spare parts through GIFT IFSC.

- Simplified tax treatment reduces overall compliance burden and accelerates transaction timelines.

Example: Tax Savings on Aircraft Lease

| Lease Value | Jurisdiction | Effective Tax/Levy Impact | Net Savings |

| USD 50M | Ireland | ~15–20% (corporate tax + WHT + stamp duty) | – |

| USD 50M | GIFT IFSC | Near-zero (10-yr tax holiday + GST & stamp duty exemption + reduced WHT) | 15–20% of lease value |

For a USD 50M lease, setting up in GIFT City can save lessors and airlines up to USD 7.5M–10M compared to offshore hubs.

Setting Up an Aircraft Leasing Company in GIFT IFSC

Establishing an aircraft leasing company in GIFT City is an attractive proposition for global lessors, domestic NBFCs, and aviation-focused investors looking to capture India’s booming aviation market. With a projected requirement of 1,500–2,000 new aircraft by 2040, the demand for leasing solutions is set to rise sharply. GIFT IFSC, backed by IFSCA’s 2022 framework, offers a transparent and globally aligned pathway for setting up both operating lease of aircrafts and finance lease of aircrafts.

Step-by-Step Process to Establish a Leasing Business

1. Choose Entity Structure: Finance Company (FC) or Finance Unit (FU)

- Finance Company (FC): A new corporate entity incorporated in GIFT IFSC under the Companies Act, 2013.

- Finance Unit (FU): A branch/unit of an existing Indian or foreign entity permitted to operate within IFSC.

- The choice depends on the lessor’s market entry strategy—new entrants often prefer FCs, while global lessors expand through FUs.

2. Meet Capitalization Requirements

- IFSCA requires minimum net-owned funds (NOF) for entities to ensure stability.

- For aircraft lessors, this acts as a safeguard for counterparties like airlines and financiers.

- Entities must also submit a clear business plan and risk management framework.

3. Register with IFSCA under the Aircraft Leasing Framework, 2022 as amended from time to time

- Submit an application detailing:

- Entity structure and ownership pattern.

- Financials and capitalization proof.

- Governance policies and compliance mechanisms.

- IFSCA grants approval after due diligence, enabling the company to begin leasing transactions.

4. Draft Lease Agreements

- Agreements must comply with international best practices, including Cape Town Convention standards.

- Flexibility to structure:

- Operating leases (short to medium term).

- Finance leases (long-term, asset-based).

- Hybrid models for customized solutions.

- Agreements must also align with DGCA safety and regulatory requirements for registration of aircraft in India.

5. Obtain DGCA and MoCA Approvals (if required)

- DGCA (Directorate General of Civil Aviation): Ensures compliance with airworthiness, safety certification, and aircraft registry.

- MoCA (Ministry of Civil Aviation): Policy alignment and sectoral approvals for large-scale leasing operations.

- These approvals, coupled with IFSCA licensing, provide a legally secure environment for lessors.

6. Execute Leasing Transactions

- Once approvals are secured, lessors can begin executing contracts with both domestic airlines (IndiGo, Air India, Akasa) and foreign carriers.

- Leasing scope includes aircraft, helicopters, engines, and spare parts.

- Financing activities such as sale-and-leaseback or structured financing are also permitted.

Comprehensive Checklist for Lessors in GIFT IFSC

| Requirement | Purpose | Status Check |

| Incorporation as FC/FU | Legal recognition of entity in IFSC | ✅ |

| Capital Adequacy (NOF) | Ensures financial credibility | ✅ |

| IFSCA License | Grants right to conduct leasing activity | ✅ |

| DGCA Compliance | Aircraft registry, safety standards | ✅ |

| MoCA Policy Alignment | Ensures sector-level policy compliance | ✅ |

| Lease Agreements | Structured under operating/finance models | ✅ |

| Tax Structuring | Optimize benefits: 10-yr tax holiday, GST & stamp duty exemption | ✅ |

| Cape Town Convention Protocols | Protects lessor rights & repossession | ✅ |

Strategic Advantages for Lessors

- Fast Track Approvals: Single-window system through IFSCA reduces delays.

- Tax Efficiency: Savings of 15–20% on lease value compared to Ireland or Singapore.

- Scalable Ecosystem: Over 20 lessors already registered by 2025, creating an emerging cluster.

- Market Access: Direct connection to Indian airlines, one of the fastest-growing aviation markets globally.

Long-Term Considerations

- Funding Options: Access to international capital markets, banks, and NBFCs through IFSC.

- Risk Management: Cape Town Convention ensures enforceability of repossession rights.

- Expansion Potential: Units can expand into related areas such as engine leasing, MRO financing, helicopters, and drones.

IFSCA Registration and Licensing Fees

To commence operations, every lessor must obtain a Certificate of Registration under the IFSCA (Finance Company) Regulations 2021 and the Aircraft Leasing Framework 2022.

- Application Fee: Typically in the range of INR 50,000–1 lakh, payable to IFSCA at the time of submitting the registration form (Form A).

- Registration Fee: Around INR 5 lakh for new applicants, covering evaluation and issuance of the license.

- Renewal Fee: Annual or bi-annual renewal charges may apply based on business volume or category (Operating / Finance).

- Fees are non-refundable and are part of the regulator’s due-diligence and supervisory cost structure.

- IFSCA also requires submission of a business plan, ownership details, and compliance framework along with the fee payment.

SEZ & GIFT City Authority Charges

Since GIFT IFSC is a Special Economic Zone (SEZ), leasing units enjoy substantial benefits but must pay nominal administrative charges to the SEZ Authority:

- Plot / Space Allotment Fee: Depending on office size and zone, typically ranges from INR 75–150 per sq. ft per month for furnished office space within GIFT SEZ towers.

- One-time Registration with GIFT SEZ Developer: Approximately INR 25,000–50,000, covering space allotment and SEZ permissions.

- Annual Maintenance / Utility Fees: Billed by the SEZ developer for common facilities, utilities, and data-connectivity infrastructure.

- No Customs Duty / GST: On import or export of aircraft, engines, or parts used for authorized operations within IFSC.

These minimal SEZ-level costs are offset by full tax exemptions, zero GST, and no stamp duty, making GIFT City among the lowest-cost jurisdictions globally for setting up aircraft leasing operations.

Opportunities & Challenges in Aircraft Leasing at GIFT City

The rapid rise of aircraft leasing in GIFT City presents India with a historic opportunity to reshape its aviation finance landscape. While the framework offers strong advantages, certain structural challenges must be addressed to sustain growth and position GIFT IFSC as a global hub.

Opportunities

1. Reduce India’s Dependency on Foreign Leasing Hubs

- Currently, over 80% of India’s commercial fleet is leased from hubs like Ireland and Singapore.

- By shifting leases to GIFT IFSC, India retains financing profits domestically and reduces exposure to foreign tax regimes.

2. Capture Global Aviation Finance Flows into Asia

- With Asia-Pacific projected to account for 40% of new aircraft deliveries by 2040, India is well-placed to channel leasing activity through GIFT City.

- This opens access to USD 5–10 billion annually in aviation finance flows.

3. Position GIFT IFSC as Asia’s Dublin for Leasing

- Ireland currently manages over 60% of the world’s leased aircraft.

- With its tax incentives, regulatory clarity, and strategic location, GIFT City can replicate this success for Asia, creating a regional hub for operating lease of aircrafts and finance lease of aircrafts.

Challenges

1. Need for Deeper Financing Ecosystem

- For sustainable growth, GIFT IFSC requires greater participation from banks, NBFCs, and capital markets in aviation finance.

- Without deep credit availability, lessors may still prefer offshore funding.

2. Risk Perception Around Repossession Enforcement

- Despite India’s adherence to the Cape Town Convention, foreign investors often remain cautious about enforcement timelines in case of default.

- Building a strong legal track record will be critical.

3. Scaling Expertise in Aviation Finance Law & Tax

- Specialized knowledge in aviation finance, cross-border tax, and structured leasing remains limited in India.

- Training professionals and attracting global advisors is essential to compete with established hubs.

Future Outlook for Aviation Finance in GIFT City

Government’s Vision

- The Indian government targets 25% of the country’s aircraft leasing to be routed through GIFT IFSC by 2030.

Financial Potential

- If achieved, GIFT City could attract USD 5–10 billion annually in aviation financing and generate significant ancillary revenue streams.

Diversification Beyond Aircraft

- Future growth is not limited to aircraft leasing:

- Engine leasing and spare parts financing.

- MRO (Maintenance, Repair & Overhaul) financing, reducing reliance on foreign repair hubs.

- Helicopter and drone leasing, supporting urban mobility and logistics.

Expanding Global Collaborations

- International lessors, law firms, and financiers are already partnering with GIFT-based units.

- Increasing global participation will accelerate knowledge transfer and strengthen India’s aviation finance ecosystem.

GIFT IFSC has the potential to become the preferred hub for aviation finance in Asia, provided it capitalizes on opportunities while addressing systemic challenges. By 2030, India could not only reduce reliance on foreign hubs but also establish itself as a leading global player in aircraft leasing and financing.

Aircraft leasing in GIFT City is transforming India’s aviation finance landscape by offering tax incentives, global-standard regulations, and a robust legal framework that rivals traditional hubs like Ireland and Singapore. With over 30% growth in leasing transactions in 2024, more than 20 registered lessors by 2025, and India’s projected demand of 2,000 aircraft by 2040, GIFT IFSC is well-positioned to become Asia’s Dublin for aviation finance. By enabling both operating leases of aircrafts and finance leases of aircrafts, reducing reliance on foreign jurisdictions, and aligning with international conventions, GIFT City provides airlines, investors, and lessors with a cost-efficient and legally secure platform. Looking ahead, with the government’s target of 25% of India’s leasing through GIFT by 2030 and potential inflows of USD 5–10 billion annually, the IFSC is set to emerge as a global hub for aircraft finance in GIFT City, driving long-term growth across the aviation sector.2

References:

- # https://www.airbus.com/sites/g/files/jlcbta136/files/2022-05/FINAL%20-%20Airbus%20IMF%20Press%20Release_Wings%20India%202022.pdf ↩︎

- # https://ifsca.gov.in/Document/10_EY-GIFT_tax_benefits_050225.pdf ↩︎

FAQs on Aircraft Leasing in GIFT City

-

What is GIFT IFSC’s role in aircraft leasing?

GIFT International Financial Services Centre (IFSC) aims to be a global hub for aviation leasing and financing. It has notified aircraft leasing (including operating, financial, and hybrid leases) as a ‘financial product’ under the International Financial Services Centres Authority (IFSCA). Its role is to provide a competitive regulatory and tax regime to encourage both domestic and international lessors to set up units and facilitate the leasing of aircraft to Indian and foreign airlines, thereby reducing India’s reliance on foreign leasing jurisdictions.

-

Can foreign companies own 100% in GIFT City leasing units?

Yes, foreign companies are generally permitted to own 100% of their subsidiary or unit set up in GIFT City IFSC for aircraft leasing activities, subject to regulatory compliance with the IFSCA framework. The units can be set up as a Company, Limited Liability Partnership (LLP), Trust, or other specified forms. Promoters from Financial Action Task Force (FATF) compliant jurisdictions are eligible.

-

What are operating vs finance leases?

- Operating Lease: This is a shorter-term arrangement where the lessor retains the ownership and most of the risks and rewards associated with the aircraft. The airline (lessee) effectively rents the asset for a period, and the aircraft is expected to be returned to the lessor at the end of the term. This is a common choice for airlines seeking fleet flexibility.

- Finance Lease (or Capital Lease): This is a long-term arrangement that transfers substantially all the risks and rewards of ownership to the lessee. The lease term often covers most of the aircraft’s economic life, and the lessee may have an option to purchase the aircraft for a nominal sum at the end. This is similar to an outright purchase financed by a loan.

-

Which airlines are using GIFT City leasing structures?

Major Indian airlines, including Air India and IndiGo, have established aircraft leasing entities in GIFT City to structure their aircraft financing and procurement. This marks a strategic shift towards domestic leasing to manage their large fleet expansion plans. The leasing units facilitate the leasing of both new and existing aircraft to the airlines.

-

What is the minimum capital requirement to set up an aircraft leasing unit in GIFT City?

The minimum owned fund requirement varies based on the type of leasing activity:

- For Operating Lease activities, the minimum owned fund is USD 200,000.

- For Financial Lease activities, the minimum owned fund is USD 3 million.

-

Which is the primary regulatory body governing aircraft leasing in GIFT City?

The primary regulatory body is the International Financial Services Centres Authority (IFSCA). The IFSCA is a unified regulator responsible for the development and regulation of financial products, financial services, and financial institutions in the IFSC. Entities must register with the IFSCA and comply with its framework for aircraft leasing.

-

How does GIFT City address repossession risks for lessors?

GIFT City enhances lessor confidence by aligning India’s legal framework with global standards. India’s recent law, which operationalises the Cape Town Convention, provides a stronger legal basis for lessors to promptly recover aircraft in the event of an airline default. This crucial step is designed to make the jurisdiction more appealing to international lessors by reducing legal and financial risks.

-

What approvals are needed to start an aircraft leasing company in GIFT City?

Entities must register with the International Financial Services Centres Authority (IFSCA) as a Finance Company or Finance Unit. They also need SEZ approval and must comply with KYC and AML norms before starting operations.

-

What are the tax benefits for aircraft leasing in GIFT City?

Aircraft leasing companies in GIFT City get a 100% tax holiday on profits for 10 consecutive years out of the first 15 years. There are also exemptions on capital gains, customs duties, withholding tax, and stamp duty under certain conditions.

-

How are defaults or insolvencies handled under the GIFT City framework?

Lessors are protected under laws aligned with the Cape Town Convention. They can repossess and deregister aircraft quickly if a lessee defaults. These rights are also protected from delays under insolvency proceedings in India.

We Are Problem Solvers. And Take Accountability.

Related Posts

AIF in GIFT City IFSC- Structures, Regulations, Benefits

AI Summary The growth of Alternative Investment Funds (AIFs) in…

Learn More

GIFT City Business Opportunities – A Deep Exploration

AI Summary GIFT City (Gujarat International Finance Tec-City) is India’s…

Learn More

GIFT City Ecosystem for Startups – A Complete Guide in 2026

AI Summary GIFT City, India's first International Financial Services Centre…

Learn More