AI Summary

Setting up an Alternative Investment Fund (AIF) in GIFT City is an attractive option for fund managers aiming for offshore flexibility within a regulated Indian framework. GIFT City, positioned as India's premier hub for global fund structuring by 2026, allows AIFs to operate with significant tax benefits, such as a ten-year tax holiday and exemptions on GST. It offers enhanced investment flexibility and access to global capital without relying on traditional offshore tax havens like Singapore and Mauritius. The structured ecosystem supports various AIF categories, each designed to cater to different investment strategies, all while ensuring compliance with international standards. With lower operational costs and streamlined regulatory processes, GIFT City emerges as a competitive alternative for global fund managers.

Last Updated on: 27th January 2026, 02:02 pm

Contents

- 1 Why Setting Up an AIF in GIFT City Matters in 2026

- 2 About GIFT City IFSC: India’s Offshore Financial Gateway

- 3 AIF Categories in GIFT City

- 4 Minimum Requirements for AIF Registration in GIFT City

- 5 Fund Management Entity (FME): Backbone of a GIFT City AIF

- 6 Step-by-Step Guide to Setting Up an AIF in GIFT City

- 7 Comparative Table: Types of AIFs Setup in GIFT City

- 8 Documentation Checklist for GIFT City AIF Registration

- 9 Benefits of Setting Up an AIF in GIFT City

- 10 Eligibility: Who Can Invest in a GIFT City AIF

- 11 Regulatory Framework for AIFs in GIFT City

- 12 Investment Scope and Participation Routes for GIFT City AIFs

- 13 Taxation of AIFs in GIFT City

Why Setting Up an AIF in GIFT City Matters in 2026

Setting up an Alternative Investment Fund in GIFT City has become a strategic choice for fund managers seeking offshore flexibility within a regulated Indian framework. By 2026, GIFT City IFSC has positioned itself as India’s primary jurisdiction for global fund structuring, combining foreign-currency operations, tax efficiency, and simplified regulation under a single authority.

What Is an AIF and Why GIFT City Is the Preferred Jurisdiction

An Alternative Investment Fund is a privately pooled investment vehicle used for private equity, venture capital, debt, real estate, and hedge strategies. GIFT City enables AIFs to operate as non-resident structures for exchange control purposes, allowing unrestricted overseas investments and foreign fundraising. Compared to domestic AIFs, setting up an AIF in GIFT City offers greater investment flexibility, lighter diversification norms, and access to global capital without relying on offshore tax havens.

GIFT City as an Alternative to Singapore and Mauritius

GIFT City now competes directly with Singapore and Mauritius by offering comparable regulatory certainty with significantly lower operational costs. Fund managers can incorporate an AIF in GIFT City while benefiting from a ten-year tax holiday, reduced minimum alternate tax, GST exemptions, and the ability to invest up to 100 percent of the fund corpus overseas. This positions GIFT City as a cost-efficient, future-ready alternative for global fund structures.

Key GIFT City AIF Ecosystem Statistics

- 116+ Fund Management Entities registered

- 143+ AIFs and fund schemes launched

- USD 11.69 billion in capital commitments raised

- USD 4.5 billion invested across India and overseas

These numbers demonstrate that GIFT City AIF formation has transitioned from early adoption to a mature, institutionally trusted fund jurisdiction.

About GIFT City IFSC: India’s Offshore Financial Gateway

GIFT City IFSC is India’s designated offshore financial jurisdiction, created to facilitate global financial services within a regulated Indian framework. It allows cross-border transactions in foreign currency while offering legal certainty, making it a preferred hub for international investments and AIF formation.

What Is an IFSC

An International Financial Services Centre is a special jurisdiction notified under the Special Economic Zones Act, 2005 to provide financial services to non-residents using foreign currency. IFSC units are treated as persons resident outside India under exchange control laws, enabling greater capital mobility.

Key features of an IFSC:

- Financial services in foreign currency only

- Focus on offshore and global investors

- SEZ status with ring-fenced regulation

- Non-resident classification under FEMA

Why GIFT City Is Unique

GIFT City is India’s only operational IFSC, combining SEZ incentives with IFSC-specific tax and regulatory benefits. It operates under a single financial regulator and offers modern infrastructure at lower operating costs, positioning it as India’s offshore gateway for global fund structuring and AIF registration.

AIF Categories in GIFT City

Alternative Investment Funds in GIFT City are classified into three categories based on investment strategy, risk profile, and use of leverage. Selecting the right category is a critical step when planning AIF registration in GIFT City, as it determines regulatory treatment, investment flexibility, and investor suitability.

Category I AIFs in GIFT City

Category I AIFs focus on long-term capital formation and development-oriented sectors. These funds typically invest in early-stage or socially impactful businesses and operate with a stable investment horizon.

Common Category I AIF structures include:

- Angel Funds investing in early-stage startups

- Venture Capital Funds supporting growth and innovation

- Infrastructure Funds targeting core infrastructure assets

- SME and Social Venture Funds focused on small enterprises and impact investing

Category II AIFs in GIFT City

Category II AIFs are the most widely used structures for private capital deployment. They offer broad investment flexibility without the use of leverage, making them suitable for traditional alternative strategies.

Typical Category II AIFs include:

- Private Equity Funds investing in unlisted companies

- Debt Funds providing structured and alternative credit

- Real Estate Funds investing in commercial properties

- Structured Credit Funds focused on fixed-income strategies

Category III AIFs in GIFT City

Category III AIFs are designed for sophisticated investors seeking market-linked returns through active trading strategies. These funds are permitted to use leverage and complex instruments.

Key features of Category III AIFs:

- Hedge Funds and long-short strategies

- Use of derivatives and advanced trading models

- Leverage permitted up to two times the fund’s net asset value

These three AIF categories provide fund managers with flexible options to set up an AIF in GIFT City aligned with their investment strategy and target investor base.

Minimum Requirements for AIF Registration in GIFT City

Understanding the minimum eligibility and financial thresholds is essential when planning AIF registration in GIFT City. These requirements ensure that only well-capitalized funds and sophisticated investors participate in the IFSC ecosystem, aligning GIFT City AIF formation with global fund standards while maintaining regulatory discipline.

Minimum Corpus and Investment Thresholds

Every AIF set up in GIFT City must meet defined minimum corpus and investor contribution requirements at the scheme level. These thresholds apply uniformly across AIF categories unless specifically relaxed for certain fund types.

| Particular | Requirement |

| Minimum scheme corpus | USD 3 million |

| Minimum investment per investor | USD 150,000 |

| Minimum investment by employee or director | USD 40,000 |

These benchmarks position GIFT City AIFs as institutional-grade funds, limiting participation to high-net-worth and accredited investors and ensuring sufficient scale for global investment strategies.

Sponsor and Manager Continuing Interest

To align the interests of fund sponsors and managers with investors, GIFT City mandates a minimum continuing interest that must be maintained throughout the life of the fund. This contribution cannot be met through fee waivers and must be in the form of capital commitment.

| AIF Category | Continuing Interest Requirement |

| Category I and II | Lower of 2.5 percent of corpus or USD 750,000 |

| Category III | Lower of 5 percent of corpus or USD 1.5 million |

This requirement strengthens governance and reinforces sponsor commitment in AIF formation in GIFT City.

Angel Fund Special Conditions

Angel Funds registered in GIFT City are subject to additional conditions reflecting their early-stage investment focus and higher risk profile.

Key Angel Fund requirements include:

- Minimum corpus of USD 750,000

- Investor eligibility based on prescribed net worth thresholds

- Investment restricted to early-stage companies within defined turnover limits

- Mandatory minimum investment per investee company, subject to an upper cap

These tailored conditions allow Angel Funds to operate with flexibility while maintaining investor protection and regulatory oversight within the GIFT City AIF framework.

Fund Management Entity (FME): Backbone of a GIFT City AIF

A Fund Management Entity is the core licensed entity through which an Alternative Investment Fund operates in GIFT City. Under the IFSC framework, regulation is centered on the fund manager rather than individual schemes, making the FME essential for AIF registration in GIFT City and ongoing regulatory compliance.

What Is a Fund Management Entity

An FME is authorised to manage investments and oversee fund operations within GIFT City IFSC. It may be set up as a company, LLP, or branch of a foreign entity and is responsible for ensuring that the AIF functions within prescribed regulatory and governance standards.

Key responsibilities of an FME include:

- Fundraising and investor management

- Portfolio and risk management

- Regulatory compliance and reporting

- Oversight of custodians and service providers

Types of FMEs in GIFT City

FMEs are classified based on investor profile and capital thresholds, allowing flexibility in fund structuring.

| FME Type | Investor Base | Minimum Net Worth |

| Authorised FME | Client portfolios | USD 75,000 |

| Registered FME Non-Retail | HNIs and accredited investors | USD 500,000 |

| Registered FME Retail | Retail and HNIs | USD 1 million |

| Family FME | Family offices | IFSC entity |

Selecting the correct FME structure is critical for efficient GIFT City AIF formation and long-term scalability.

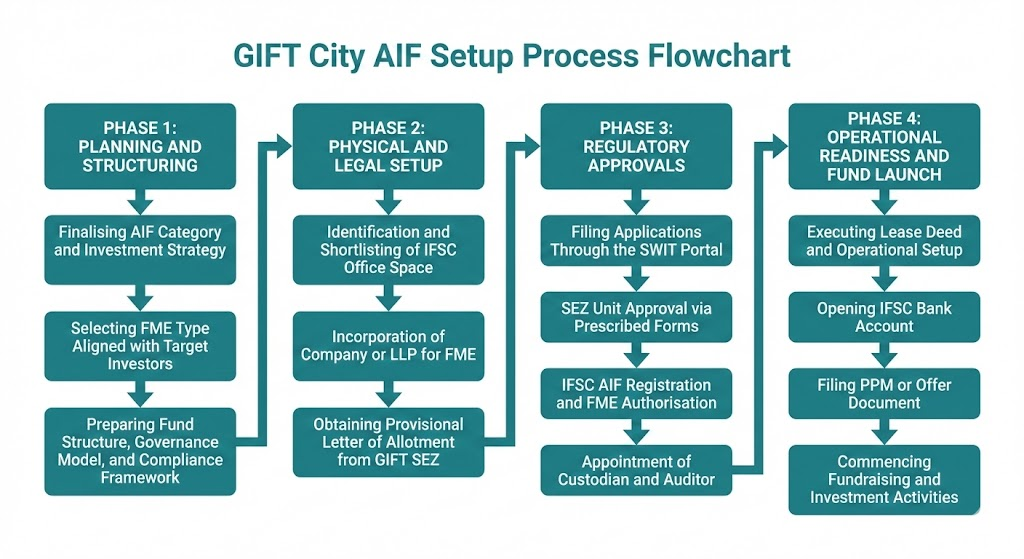

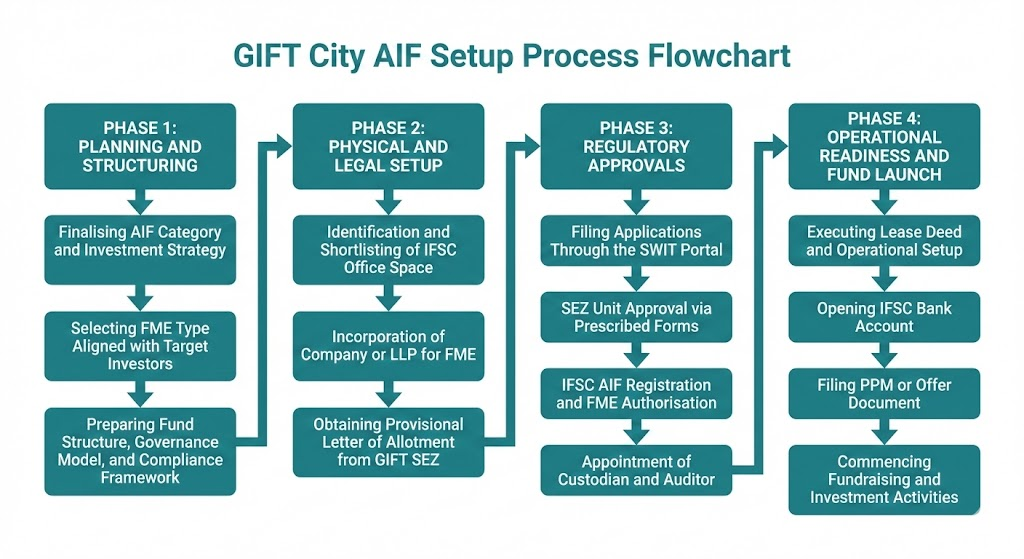

Step-by-Step Guide to Setting Up an AIF in GIFT City

Setting up an AIF in GIFT City follows a clearly defined, regulator-driven lifecycle that integrates SEZ approvals, IFSC regulations, and fund management licensing into a single coordinated process. Unlike domestic AIF incorporation, GIFT City AIF formation places strong emphasis on upfront structuring, physical substance, and centralized oversight.

Phase 1: Planning and Structuring

This phase determines whether the fund structure is viable, scalable, and regulator-ready. Errors at this stage often lead to delays later, making it the most critical part of setting up an AIF in GIFT City.

Step 1.1: Decide the AIF Category and Investment Strategy

The sponsor must first determine the appropriate AIF category based on the proposed investment approach:

- Category I for angel, venture capital, infrastructure, SME, and socially oriented funds

- Category II for private equity, debt, real estate, and structured credit strategies

- Category III for hedge funds and trading strategies where leverage up to two times is permitted

This choice impacts leverage eligibility, compliance intensity, fee structures, and investor disclosures.

Step 1.2: Select the Appropriate FME Type

Next, the sponsor selects the Fund Management Entity structure aligned with the target investor base:

- Authorised FME for portfolio management mandates

- Registered non-retail FME for pooled AIFs targeting HNIs and accredited investors

- Registered retail FME for funds with wider investor participation

- Family FME for proprietary or family office capital

The FME type determines minimum net worth, staffing requirements, and permissible activities.

Step 1.3: Draft Fund Structure and Jurisdictional Analysis

This step involves preparing detailed documentation covering:

- Legal form of the fund and manager

- Management and governance arrangements

- Tax positioning and pass-through analysis

- Investor flow and currency mechanics

- Risk management and compliance framework

Regulators closely scrutinize this analysis during the AIF registration process.

Outputs of Phase 1:

- Finalized AIF category and strategy

- Confirmed FME structure

- Complete fund structure and governance blueprint

Phase 2: Physical and Legal Setup

GIFT City requires demonstrable economic substance. Physical and legal establishment is therefore a mandatory compliance requirement, not a procedural formality.

Step 2.1: Identify and Secure Office Space in GIFT IFSC

The sponsor must identify suitable office premises within the GIFT City IFSC zone. The space must:

- Comply with SEZ norms

- Be dedicated exclusively to authorized IFSC operations

- Serve as the registered address for regulatory approvals

Step 2.2: Incorporate FME

The FME is incorporated as a company or LLP under Indian law. This entity becomes the applicant for SEZ approval, IFSC registration, and banking relationships.

Step 2.3: Obtain Provisional Letter of Allotment

After identifying office space, the entity applies to the GIFT City developer for a Provisional Letter of Allotment. The PLOA confirms provisional allocation of space and is mandatory for filing SEZ and IFSC applications.

Outputs of Phase 2:

- Incorporated FME entity

- Identified IFSC office space

- Provisional Letter of Allotment issued

Phase 3: Regulatory Approvals

This phase involves formal authorization and is the most compliance-intensive stage of GIFT City AIF incorporation.

Step 3.1: File Applications via the SWIT Portal

All approvals are routed through the Single Window IT portal, enabling parallel processing by SEZ authorities and the IFSC regulator. Required filings include incorporation documents, business plan, board resolutions, and promoter KYC.

Step 3.2: Obtain SEZ Unit Approval

The entity submits the prescribed application and forms to the Development Commissioner to obtain SEZ unit status. This approval designates the entity as eligible for SEZ fiscal and operational benefits.

Step 3.3: Apply for IFSC AIF Registration

In parallel, the application for AIF registration and FME authorization is submitted. This includes disclosures on:

- Investment strategy and asset classes

- Sponsor and management background

- Risk management systems

- Compliance and governance policies

Step 3.4: Appoint Mandatory Service Providers

Before approval, the AIF must appoint:

- A custodian for asset safekeeping

- A statutory auditor for financial oversight

These appointments demonstrate operational readiness and investor protection.

Outputs of Phase 3:

- SEZ unit approval

- IFSC AIF registration

- FME authorization

- Custodian and auditor appointed

Phase 4: Operational Readiness and Fund Launch

Once approvals are granted, the focus shifts from regulatory setup to operational execution and fundraising.

Step 4.1: Execute Final Lease and Establish Substance

The entity executes the final lease deed with the developer, establishing permanent physical presence within GIFT City and satisfying substance requirements.

Step 4.2: Open IFSC Bank Account

An IFSC bank account is opened with an authorized IFSC banking unit to:

- Receive foreign currency capital

- Pay operational expenses

- Route investments and distributions

Step 4.3: File Private Placement Memorandum or Offer Document

The fund files its PPM or offer document detailing:

- Investment objectives and strategy

- Risk factors

- Fee and expense structure

- Governance and exit rights

Step 4.4: Commence Fundraising and Investments

After acceptance of the offer document, the AIF is permitted to onboard investors, raise capital, and begin deploying funds.

Outputs of Phase 4:

- Operational office and banking setup

- Approved PPM or offer document

- Fundraising and investment activities commenced

This phased, sub-step driven approach ensures that setting up an AIF in GIFT City is compliant, scalable, and aligned with global fund management standards while remaining efficient and regulator-friendly.

End-to-End Process Flow for GIFT City AIF Incorporation

| Stage | Key Outcome |

| Planning and structuring | AIF category, FME type, fund structure finalised |

| Physical and legal setup | Office space, entity incorporation, PLOA |

| Regulatory approvals | SEZ authorisation and IFSC AIF registration |

| Operational readiness | Bank account, PPM filing, fund launch |

Key Compliance and Cost Snapshot

| Item | Typical Requirement |

| Minimum scheme corpus | USD 3 million |

| IFSC application fee | USD 2,500 |

| IFSC registration fee for FME | USD 7,500 |

| PPM filing fees | USD 7,500 to USD 22,500 depending on category |

| Leverage | Permitted |

| Diversification limits | No regulatory cap across categories |

By following this phased approach, fund sponsors can efficiently complete GIFT City AIF incorporation while ensuring full regulatory compliance, faster approvals, and readiness to attract global capital.

Comparative Table: Types of AIFs Setup in GIFT City

The table below provides a clear, side-by-side comparison of all three AIF categories in GIFT City. This helps fund sponsors quickly identify the most suitable structure when planning AIF registration in GIFT City or evaluating fund strategy, compliance intensity, and investor expectations.

Comparison of Category I, II, and III AIFs in GIFT City

| Criteria | Category I AIF | Category II AIF | Category III AIF |

| Primary purpose | Developmental and growth-oriented investments | Private capital and structured investments | Market-linked and trading strategies |

| Typical fund types | Angel Funds, Venture Capital Funds, Infrastructure Funds, SME and Social Venture Funds | Private Equity Funds, Debt Funds, Real Estate Funds, Structured Credit Funds | Hedge Funds, Long-only Funds, Long-short Funds |

| Investor profile | Sophisticated and long-term investors | Institutional, HNIs, accredited investors | Sophisticated and high-risk investors |

| Minimum scheme corpus | USD 3 million | USD 3 million | USD 3 million |

| Minimum investment per investor | USD 150,000 | USD 150,000 | USD 150,000 |

| Sponsor or manager continuing interest | Lower of 2.5 percent of corpus or USD 750,000 | Lower of 2.5 percent of corpus or USD 750,000 | Lower of 5 percent of corpus or USD 1.5 million |

| Use of leverage | Permitted | Permitted | Permitted |

| Investment in listed securities | Limited and category-specific | Up to 49.99 percent | Up to 100 percent |

| Diversification limits | No regulatory limits | No regulatory limits | No regulatory limits |

| Open or close ended | Close ended | Close ended | Open or close ended |

| Overall compliance intensity | Moderate | Low | High |

| QIB status | Yes | Yes | Yes |

| Suitability for global strategies | Moderate | High | Very high |

This comparative view highlights why Category II and Category III AIFs are most commonly used for GIFT City AIF incorporation, while Category I remains preferred for venture and developmental strategies.

Documentation Checklist for GIFT City AIF Registration

Accurate and complete documentation is essential for smooth AIF registration in GIFT City. The regulator places strong emphasis on legal validity, governance standards, and investor protection. Well-prepared documents reduce regulatory queries and speed up approvals during GIFT City AIF formation.

Key Documents Required

Incorporation Documents

These confirm the legal existence and authority of the Fund Management Entity.

- Memorandum and Articles of Association or LLP deed

- Certificate of incorporation and constitutional approvals

Business Plan and Investment Strategy

This outlines how the AIF will operate and deploy capital.

- Investment objectives and asset classes

- Target sectors, geography, and exit strategy

- Fee structure and fund economics

Sponsor and Manager KYC

Used to assess fitness and propriety of key persons.

- Identity and address proofs

- Ownership structure and background disclosures

Risk Management and Compliance Policies

Demonstrate governance and operational readiness.

- Risk identification and mitigation framework

- Internal controls and conflict management

AML and CFT Framework

Ensures compliance with global financial integrity standards.

- Investor due diligence procedures

- Ongoing monitoring and reporting mechanisms

Private Placement Memorandum

Primary disclosure document for investors.

- Investment strategy and risk factors

- Fees, governance rights, and exit terms

A complete and consistent documentation set is critical for timely GIFT City AIF registration and fund launch.

Benefits of Setting Up an AIF in GIFT City

Setting up an AIF in GIFT City offers a unique combination of regulatory flexibility, tax efficiency, and global market access. The IFSC framework is specifically designed to support international fund structures, making GIFT City AIF formation attractive for both domestic and foreign fund managers.

Key Benefits of GIFT City AIF Registration

Regulatory and Structural Advantages

GIFT City provides an offshore-equivalent regulatory environment within India, allowing fund managers to operate with greater freedom compared to domestic AIFs.

- Single regulator for funds and fund managers

- Ability to operate entirely in foreign currency

- No mandatory diversification limits across AIF categories

- Liberal leverage framework for Category III AIFs

Tax Efficiency

Tax incentives significantly improve fund-level and investor-level returns.

- 100 percent tax holiday on business income for 10 out of 15 years

- Tax pass-through status for Category I and II AIFs

- Reduced minimum alternate tax at 9 percent

- No GST on fund management services

- Exemptions from STT, CTT, and stamp duty

Global Investment Flexibility

GIFT City AIFs are built for cross-border capital deployment.

- Ability to invest up to 100 percent of the fund corpus overseas

- Access to Indian and global markets through FDI, FPI, and FVCI routes

- No domestic caps on overseas investments

Cost and Operational Benefits

Compared to offshore hubs, GIFT City offers lower setup and operating costs.

- Reduced compliance and regulatory overhead

- Availability of skilled financial talent

- World-class infrastructure with SEZ benefits

Why Fund Managers Choose GIFT City

These benefits position GIFT City as a competitive alternative to traditional offshore jurisdictions, enabling fund managers to combine global investment reach with regulatory clarity and long-term cost efficiency when setting up an AIF in GIFT City.

Eligibility: Who Can Invest in a GIFT City AIF

Investor eligibility for a GIFT City AIF is designed to attract global capital while ensuring participation is limited to financially sophisticated investors. The framework prioritizes non-resident and institutional investors but also allows limited participation by resident Indians under defined conditions. Understanding eligibility is essential when structuring AIF registration in GIFT City and planning fundraising strategies.

Who Is Eligible to Invest in a GIFT City AIF

GIFT City AIFs are primarily structured to pool foreign capital and deploy it into Indian and global opportunities. As a result, the investor base is broader and more internationally oriented compared to domestic AIFs.

Eligible investors typically include:

- Non-resident individuals and entities

- Foreign Portfolio Investors and Foreign Institutional Investors

- Sovereign wealth funds and pension funds

- Overseas family offices and global fund-of-funds

- Resident Indians, subject to Liberalised Remittance Scheme limits and prescribed net worth thresholds

While Indian residents can invest, such participation is regulated to prevent round-tripping and is generally used for offshore investments rather than India-focused deployment.

Accredited Investor Framework in GIFT City

To maintain market integrity and investor protection, GIFT City follows an accreditation-based approach for non-retail funds. Accredited investors benefit from relaxed minimum investment thresholds and broader access to fund strategies.

An investor is considered accredited if they meet any of the following:

- Annual income of at least USD 200,000

- Net assets of at least USD 1 million, excluding primary residence

- Institutional investors such as sovereign funds, pension funds, and multilateral agencies, which are automatically deemed accredited

This eligibility framework ensures that GIFT City AIF formation remains aligned with global best practices for alternative investments.

Regulatory Framework for AIFs in GIFT City

Which Authority Regulates GIFT City AIFs

All AIFs set up in GIFT City are regulated by the International Financial Services Centres Authority, which acts as the unified regulator for financial services within the IFSC. This centralized oversight simplifies compliance, accelerates approvals, and aligns fund regulation with global standards rather than domestic-only frameworks.

Applicable Laws and Regulations

The regulatory framework for setting up an AIF in GIFT City draws from adapted securities and exchange control laws, tailored for offshore operations:

- International Financial Services Centres Authority as the primary regulator

- Foreign Exchange Management IFSC Regulations, 2015, treating IFSC entities as non-resident

- IFSCA Fund Management Regulations governing fund managers under a consolidated regime

This structure allows fund managers to incorporate an AIF in GIFT City with reduced regulatory friction and greater operational flexibility.

Investment Scope and Participation Routes for GIFT City AIFs

A key advantage of setting up an AIF in GIFT City is the breadth of investment flexibility available under the IFSC framework. GIFT City AIFs are designed for cross-border capital deployment and can invest freely across asset classes and jurisdictions without the restrictive caps applicable to domestic funds.

Where Can a GIFT City AIF Invest

GIFT City AIFs are permitted to invest across a wide range of instruments and entities, enabling diversified global strategies.

Permissible investments include:

- Securities listed on IFSC exchanges

- Securities of companies incorporated in India and foreign jurisdictions

- Units of other Alternative Investment Funds

- REITs, InvITs, derivatives, LLPs, and special purpose vehicles

- Overseas entities without domestic investment caps

This flexibility allows fund managers to structure globally diversified portfolios directly from GIFT City.

Routes for Investing into India

When deploying capital into India, GIFT City AIFs can choose among multiple foreign investment routes depending on asset type and strategy:

- Foreign Direct Investment route for strategic and long-term investments

- Foreign Portfolio Investor route for listed and market-linked investments

- Foreign Venture Capital Investor route for startup and venture investments

These participation routes make GIFT City AIF formation particularly attractive for funds targeting both Indian and international investment opportunities.

Taxation of AIFs in GIFT City

Direct Tax Benefits for GIFT City AIFs

GIFT City AIFs and their managers enjoy several direct tax advantages:

- 100 percent tax holiday on business income for any 10 consecutive years out of the first 15 years

- Tax pass-through status for Category I and Category II AIFs

- Reduced Minimum Alternate Tax at 9 percent

- A Category III AIF is subject to fund-level taxation; however, non-resident investors are exempt from tax on income arising from the transfer of Indian securities, other than shares of an Indian company.

- No requirement for eligible non-resident investors to obtain PAN or file Indian tax returns

Category-wise Tax Treatment

| AIF Category | Tax Treatment |

| Category I and II | Pass-through taxation |

| Category III | Taxed at fund level except capital gains |

Indirect Tax and Other Exemptions

Additional fiscal incentives further enhance the attractiveness of GIFT City AIF formation:

- GST exemption on fund management services

- Exemption from securities transaction tax, commodity transaction tax, and stamp duty

- Customs duty relief for authorized IFSC operations

These tax benefits position GIFT City as a highly efficient jurisdiction for global fund structuring and investment management.

For our complete guide on AIFs in GIFT City IFSC read this article.

Setting up an AIF in GIFT City represents a strategic shift toward globally aligned fund structuring within a robust Indian regulatory framework. With its IFSC status, unified regulation, tax efficiency, and unrestricted cross-border investment capability, GIFT City offers fund managers a future-ready alternative to traditional offshore jurisdictions. The combination of flexible AIF regulations, strong governance standards, cost advantages, and access to global capital positions GIFT City as the preferred destination for AIF registration and long-term fund management. As the ecosystem continues to mature, GIFT City AIF formation is increasingly becoming the default choice for sponsors seeking scalable, compliant, and internationally competitive investment platforms.

FAQs on Setting Up an AIF in GIFT City

-

Who regulates AIFs set up in GIFT City?

AIFs in GIFT City are regulated by the International Financial Services Centres Authority, which acts as the single regulator for fund managers and funds operating within the IFSC. This unified regulation replaces the multi-regulator oversight applicable to domestic AIFs and simplifies compliance.

-

Can Indian residents invest in a GIFT City AIF?

Yes, resident Indians can invest in a GIFT City AIF, subject to conditions under the Liberalised Remittance Scheme and prescribed net worth thresholds. Such investments are typically permitted for offshore deployment and must comply with exchange control and anti-round-tripping rules.

-

What is the minimum corpus required to set up an AIF in GIFT City?

Each AIF scheme in GIFT City must have a minimum corpus of USD 3 million. Additionally, the minimum investment per investor is USD 150,000, while employees or directors of the fund manager may invest a reduced minimum of USD 40,000.

-

Is physical presence mandatory for AIF registration in GIFT City?

Yes, physical presence is mandatory. The fund manager must have an office within the GIFT City IFSC zone and execute a lease deed. This substance requirement is essential for SEZ approval and IFSC registration.

-

Can a GIFT City AIF invest outside India?

Yes, GIFT City AIFs can invest up to 100 percent of their corpus in overseas securities and entities. Unlike domestic AIFs, there are no regulatory caps on offshore investments, making GIFT City suitable for global fund strategies.

-

What are the tax benefits available to GIFT City AIFs?

GIFT City AIFs benefit from a ten-year tax holiday on business income, tax pass-through for Category I and II AIFs, reduced minimum alternate tax, GST exemption on fund management services, and exemptions from securities transaction tax, commodity transaction tax, and stamp duty.

-

Is a Fund Management Entity mandatory to set up an AIF in GIFT City?

Yes, every GIFT City AIF must be managed by a licensed Fund Management Entity. The FME is responsible for fundraising, portfolio management, compliance, and regulatory reporting, and is the primary entity regulated by the IFSC authority.

-

How long does it typically take to set up an AIF in GIFT City?

The timeline depends on preparedness and regulatory queries, but a well-structured application generally takes a few months. Delays most often arise from incomplete documentation, unclear fund structures, or delays in securing office space and service providers.

We Are Problem Solvers. And Take Accountability.

Related Posts

AIF in GIFT City IFSC- Structures, Regulations, Benefits

AI Summary The growth of Alternative Investment Funds (AIFs) in…

Learn More

GIFT City Business Opportunities – A Deep Exploration

AI Summary GIFT City (Gujarat International Finance Tec-City) is India’s…

Learn More

GIFT City Ecosystem for Startups – A Complete Guide in 2026

AI Summary GIFT City, India's first International Financial Services Centre…

Learn More