Page Contents

- What is a Family Office?

- What is International Financial Service Centre (IFSC)?

- Residential Status of Units in IFSC

- IFSC in India

- Family Offices in India and Family Investment Funds

- Key Aspects of an FIF

- Tax and Exchange Control Regulations

- Pre-Requisites for FIF Application

- Sharing Economic Interest with Stakeholders

- Exit for stakeholders with Economic Interest

The Indian government has recently relaxed the regulations for family offices in the International Financial Service Centre (IFSC), making it an attractive option for wealthy families looking to manage their wealth and invest globally. Family offices in IFSC can set up a Family Investment Fund (FIF), which is a self-managed fund that can pool money from a single family and invest in a variety of assets, including equities, debt, and real estate. However, before getting into the benefits and details, it is important to understand what is a Family Office and What is IFSC

What is a Family Office?

A family office is a privately held company that handles investment management and wealth management for a wealthy family with the goal being to effectively grow and transfer wealth across generations.

Family offices can be either single-family offices or multi-family offices. A single-family office is owned and operated by a single family, while a multi-family office is owned and operated by multiple families.

What is International Financial Service Centre (IFSC)?

An International Financial Services Centre (IFSC) is a special economic zone that is designed to attract foreign investment in financial services. An International Financial Services Centre (IFSC) caters to customers outside the jurisdiction of domestic economy. Such centres deal with the flow of finance, financial products and services across the borders. The IFSC offers a wide range of financial services, including Banking, Insurance, Asset management, Commodity trading, Derivatives trading, Foreign exchange trading, Stock broking.

IFSC typically offer a number of benefits to financial institutions, such as:

- Favourable Tax Regime

- Liberal Regulatory Environment

- Strong Infrastructure

- Skilled Workforce

An IFSC as envisaged under the Indian context “is a jurisdiction that provides financial services to non-residents and residents (institutions) in any currency other than Indian Rupee (INR)”

An IFSC is set up to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions

Residential Status of Units in IFSC

- Under Foreign Exchange Management regulations – Non-Resident

- Under Income tax laws – Resident

IFSC in India

The first IFSC in India is the Gujarat International Finance Tec-City (GIFT City), which is located in Gandhinagar, Gujarat. GIFT City was established in 2015 and it is currently home to over 100 financial institutions.

In India, an IFSC is approved and regulated by the Government of India under the Special Economic Zones Act, 2005. Government of India has approved GIFT City as a Multi Services Special Economic Zone (‘GIFT SEZ’) and has also notified this zone as India’s IFSC. The launch of the IFSC at GIFT City is the first step towards bringing financial services transactions relatable to India, back to Indian shores

Family Offices in India and Family Investment Funds

India’s financial wealth is projected to reach USD $5.5 trillion by 2025, at a growth rate of 10% annually1. India is also witnessing a surge in US-dollar millionaires, expected to double by 20262. As a result, there is a growing need for family offices.

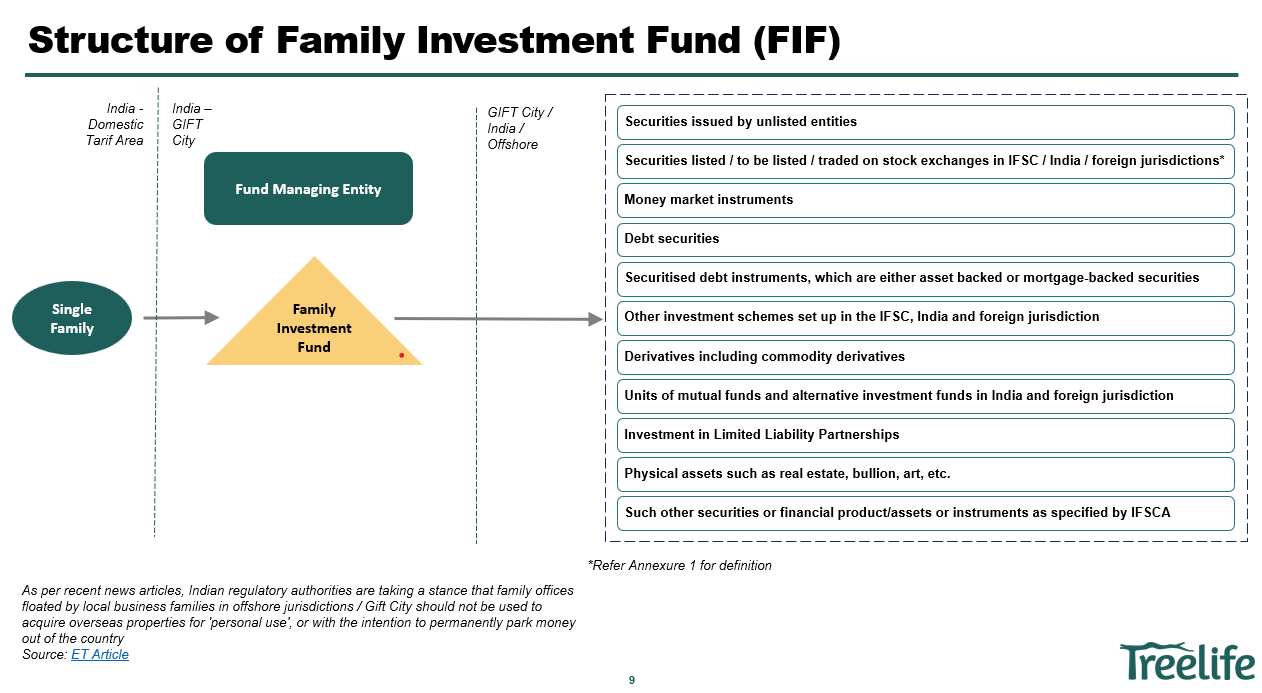

The Indian regulators have provided a formal recognition to family offices under the International Financial Services Centres Authority (Fund Management) Regulations, 2022 (“FM Regulations“) with the aim to encourage more Indian family offices to establish Family Investment Fund (FIF) in GIFT City, competing with Singapore and Dubai.

As per FM Regulations, FIF and Single family is defined as follows:

| Terms | Description |

| Family Investment Fund | A self-managed fund pooling money only from a single family and has been set up in terms of International Financial Services Centre Authority (Fund Management) Regulations, 2022 |

| Single Family | A group of individuals who are the lineal descendants of a common ancestor and includes their spouses (including widows and widowers, whether remarried or not) and children (including stepchildren, adopted children, ex nuptial children); Single family shall also include entities such as sole proprietorship firm, partnership firm, company, LLP, trust or a body corporate, in which an individual or a group of individuals of a single family exercises control and directly or indirectly hold substantial economic interest “substantial economic interest” shall mean at least 90% economic interest, as demonstrated by FIF in an appropriate manner to the satisfaction of IFSCA which may, inter alia, include: – % of shareholding in case of a company with share capital; or right to exercise control in case of a company without share capital; – % share of profits in case of partnership firm and LLP; – % of beneficial interest specified in trust deed in case of a determinate trust; or pro-rata share in the trust property in case of an indeterminate trust; or – any other manner as may be demonstrated to the satisfaction of IFSCA |

Key Aspects of an FIF

| Terms | Particulars |

| Registration | FIF to be registered with IFSCA as an Authorized Fund Management Entity (FME) |

| Possible Form | FIF can be incorporated in any of the following forms : – Company or – Trust* or – LLP * In case of a trust, the following needs to be kept in mind: (a) beneficiaries should be identifiable in the Trust deed (though not specifically named) (b) each beneficiary’s share should be capable of being determined based on the provision/formula mentioned in the trust deed (should not be at the discretion of the trustee) (c) any addition of further contributors to the Trust in addition to the initial contributors, shall not make the existing beneficiaries unknown or their shares indeterminate. |

| Minimum Corpus | Minimum corpus requirement is USD 10 million to be met and maintained within 3 years from registration |

| Tenure | The tenure of the FIF can be open ended or close ended depending on family requirements |

| Investment Limits | – For Resident Individuals -To invest under LRS which is capped at USD 250,000 per person per financial year – For Indian Entity – 50% of the net worth |

| Undertaking to PO | Before the FIF commences investment activities, all individuals of a single family who contribute to the FIF directly or indirectly, shall give an undertaking to the Principal Officer, to the effect that they understand the risks, costs and benefits of investing in the FIF and that the usual investor protection measures such as disclosures, regulatory inspection and supervision, etc., may not be available to the same extent to the FIF as they are to other schemes in IFSC. |

| Borrowing | FIF may borrow funds or engage in leveraging activities as per their risk management policy |

| Setting up additional invesmtent vehicles | – FIF may set-up additional investment vehicles (company / LLP / Trust / other form as specified by IFSCA) subject to prior approval of IFSCA and payment of fee as applicable to a FIF. – Such additional vehicles shall also be considered as part of the FIF for the purpose of meeting the requirements specified in the regulations |

Tax and Exchange Control Regulations

| Terms | Particulars |

| Taxation of Income | – 100% exemption of Business income for 10 consecutive years out of 15 years – Capital gain on investments can be characterized as business profits, subjective |

| MAT/AMT | – Where FIF set up as a company – No MAT – Where FIF set up as an LLP – AMT of ~10.48% (including surcharge and cess) |

| TCS | TCS provisions should not apply to OPI remittances (outside of LRS) |

| Amount of Investment | – For individuals – LRS limits of USD 250,000 per annum – For unlisted company / LLP / firms – Can invest upto 50% of networth under OPI (Refer Annexure 3 for more details) |

Pre-Requisites for FIF Application

- Principal officer (PO)

- The applicant shall designate a principal officer who shall be responsible for overall activities of the FME including but not limited to fund management, risk management and compliance.

- PO to be based out of IFSC

- PO to meet following experience:

- A professional qualification or post-graduate degree or post graduate diploma (minimum two years in duration) in finance, law, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science from a university or an institution recognised by the Central Government or any State Government or a recognised foreign university or institution or association; or a certification from any organization or institution or association or stock exchange which is recognised/ accredited by Authority or a regulator in India or Foreign Jurisdiction; and

- An experience of at least 5 years in related activities in the securities market or financial products including in a portfolio manager, broker dealer, investment advisor, wealth manager, research analyst or fund management.

- Any changes to PO to be with prior approval of IFSCA

2. Other Personnel FIF is required to appoint other personnel commensurate to the size of its operations and activities.

3. Fit and Proper The Applicant, PO, directors/ partners/ designated partners, key managerial personnel and controlling shareholders shall be fit and proper persons, at all times. A person shall be deemed to be a fit and proper person if :-

- such person has a record of fairness and integrity, including but not limited to-

- financial integrity;

- good reputation and character; and

- honesty

- such person has not incurred any of the following disqualifications –

- the person has been convicted by a court for any offence involving moral turpitude or any economic offence or any offence against securities laws;

- a recovery proceeding has been initiated against the person by a financial regulatory authority and is pending;

- an order for winding up has been passed against the person for malfeasance;

- the person has been declared insolvent and not discharged;

- an order, restraining, prohibiting or debarring the person from accessing or dealing in financial products or financial services, has been passed by any regulatory authority, and a period of three years from the date of the expiry of the period specified in the order has not elapsed;

- any other order against the person, which has a bearing on the securities market, has been passed by the Authority or any other regulatory authority, and a period of three years from the date of the order has not elapsed;

- the person has been found to be of unsound mind by a court of competent jurisdiction and the finding is in force;

- the person is financially not sound or has been categorized as a wilful defaulter;

- the person has been declared a fugitive economic offender; or

- any other disqualification as may be specified by the Authority.

4. Infrastructure

- FIF should have necessary infrastructure like adequate office space, equipment, communication facilities and manpower to effectively discharge its activities

- The infrastructure requirements should be commensurate to the size of its operations in IFSC

- The office should be dedicated, secured and accessible only by authorised persons of the FIF

5. Period of Validity The certificate of registration of FIF would remain valid for such period as may be specified by IFSCA unless it is suspended or cancelled by IFSCA or surrendered by FIF and taken on record by IFSCA

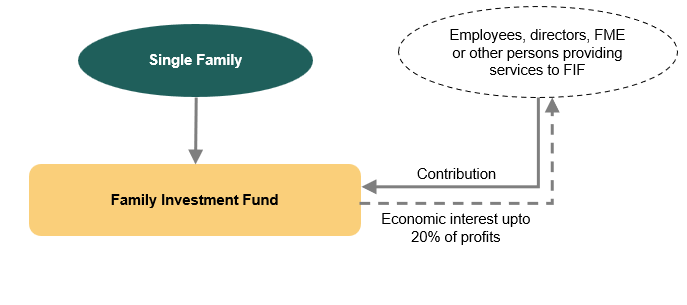

Sharing Economic Interest with Stakeholders

- An FIF cannot seek money from individuals / entities outside of the single family. However, FIF may share economic interest with its employees, directors, FME or other persons providing services to the FIF, as per its internal policy to reward the persons providing services to the FIF or to align the interest of such persons with those of the FIF.

- The FIF may accept contributions from the aforementioned persons for the limited purpose of granting economic interest to them, which in no case shall exceed an aggregate of 20% of FIF’s profits. Also, such external persons should be informed of the risks of investment in the FIF.

Exit for stakeholders with Economic Interest

- Exit may be offered by any person / group of persons from the single family who already holds interest in FIF

- Price for acquisition should not be less than the price determined by an independent third-party service provider such as a fund administrator or custodian registered with the IFSCA, a valuer registered with IBBI or such other person as may be specified by IFSCA.

- Such service provider shall take into account the following factors:

- highest price paid by any person for acquiring any interest in FIF during the last 12 months;

- the fair price of the FIF, to be determined after taking into account valuation parameters including return on net worth, book value, earning per share, price earning multiple vis-à-vis the industry average, and such other parameters as are customary for valuation of such entities.

- Service provider shall also provide a valuation report giving justification for such valuation.

Treelife experts are here to assist you. If you have any questions, please feel free to reach out to us on 9930156000