Are you looking to venture into the lucrative world of bullion trading in India? The India International Bullion Exchange (IIBX) in GIFT City, Gujarat, is rapidly emerging as the premier gateway for efficient and compliant bullion trade in GIFT City. This comprehensive guide will walk you through everything you need to know about setting up bullion trade in GIFT City in 2025.

Why GIFT City is the Premier Destination for Bullion Trading for 2025

GIFT City (Gujarat International Finance Tec-City) is rapidly solidifying its position as the go-to hub for starting bullion trading and setting up bullion trade in India. Designed as a global financial services center, it offers unparalleled advantages for businesses looking to engage in the precious metals market, making it the strategic choice.

Strategic Advantages for Bullion Businesses

- Global Access & Time Zone Advantage: GIFT City’s strategic geographical location offers a crucial time zone advantage, facilitating seamless global bullion trade operations across major markets, from East to West. This reduces operational overlaps and extends trading hours.

- Robust Regulatory Framework: Regulated by the International Financial Services Centres Authority (IFSCA), GIFT City provides a transparent, secure, and conducive environment for setting up bullion trading. IFSCA’s clear guidelines foster trust and efficiency in all bullion-related activities.

- World-Class Infrastructure: Investing in bullion trade in GIFT City means access to state-of-the-art infrastructure. This includes advanced trading platforms, secure vaulting facilities for physical bullion, and comprehensive financial services, ensuring efficient and safe operations.

- Streamlined Direct Import Gateway: The presence of the India International Bullion Exchange (IIBX) within GIFT City acts as a direct import gateway for bullion into India. This significantly simplifies and accelerates the process of setting up bullion trade and importing precious metals, cutting down on logistical complexities.

IIBX: Your Gateway to India’s Bullion Market

Central to starting bullion trading in GIFT City is the India International Bullion Exchange IFSC Limited (IIBX). Launched in July 2022, IIBX is conceptualized as the principal entry point for bullion imports into India, fostering a world-class ecosystem for bullion trading, investment in related financial products, and secure vaulting services within the IFSC.

Core Features of the India International Bullion Exchange

- IFSCA Regulation: IIBX operates under the strict oversight of the IFSCA, ensuring high standards of transparency, market integrity, and compliance for all participants engaged in bullion trading.

- Strong Institutional Backing: Promoted by India’s leading market infrastructure institutions, including NSE, INDIA INX (a subsidiary of BSE), NSDL, CDSL, and MCX, IIBX provides a robust and reliable platform for setting up bullion trading.

- Innovative Settlement & Payouts: IIBX is recognized for its “Global First Initiatives,” notably the “Every 30 minutes Settlement of BDR (Bullion Depository Receipts)” and direct pay-outs to buyers. This rapid settlement process enhances liquidity and operational efficiency for bullion trade.

- USD-based Hedging: Entities can leverage USD-based pricing for gold futures on IIBX. This feature eliminates the need for establishing overseas subsidiaries for hedging operations, simplifying risk management for those starting bullion trading and wanting to hedge their price risk.

Who Can Participate in Bullion Trading at IIBX in GIFT City?

The India International Bullion Exchange (IIBX) in GIFT City is designed to be an inclusive platform, welcoming a diverse range of participants keen on setting up bullion trade in GIFT City. Understanding the various roles is key to leveraging the opportunities presented by this thriving ecosystem for starting bullion trading.

Key Players in the IIBX Ecosystem

For those considering setting up bullion trading, IIBX accommodates several categories of entities, each with distinct functions and specific onboarding requirements:

- Qualified Jewellers (QJ): Qualified Jewellers (QJ) are entities actively engaged in the precious metals business under specific ITS(HS) codes, and they must meet defined net worth and turnover criteria to participate in bullion trading on the IIBX. To qualify, a QJ must have a minimum net worth of ₹25 crore, as per its latest audited financial statement. The net worth is calculated by adding the paid-up share capital, reserves created from profits, and securities premium account, while deducting accumulated losses and unamortized expenditures. Additionally, QJs must ensure that 90% of their average annual turnover over the past three years comes from dealings in precious metals. They are empowered to import both gold and silver directly through IIBX and can hold Tariff Rate Quotas (TRQs). Furthermore, QJs must provide a net worth certificate from a practicing Chartered Accountant, Cost Accountant, or Company Secretary, and comply with the ‘fit and proper’ criteria under Regulation 51(2) of the IFSCA (Bullion Exchange) Regulations, 2020.

- Tariff Rate Quota (TRQ) Holders: These are entities holding valid India-UAE TRQ licenses or authorizations from the Directorate General of Foreign Trade (DGFT). Their primary advantage is the ability to import UAEGD gold under the India-UAE Comprehensive Economic Partnership Agreement (CEPA) at a concessional customs duty.

- Gold and Silver Futures Hedgers: This category includes domestic residents (excluding individuals) who have exposure to gold and silver price fluctuations. IIBX offers a dedicated platform for them to hedge their price risk using gold and silver futures contracts.

- Other Bullion Market Stakeholders: Beyond these primary categories, the IIBX ecosystem also facilitates participation from a broader range of crucial entities, including:

- Refiners

- Bullion Dealers

- Bullion Importers

- Jewellery Exporters

- Special Category Clients (SCCs)

- International Clients

Each of these participant types contributes to a robust and dynamic environment for bullion trading in GIFT City, fostering liquidity and diverse market activities.

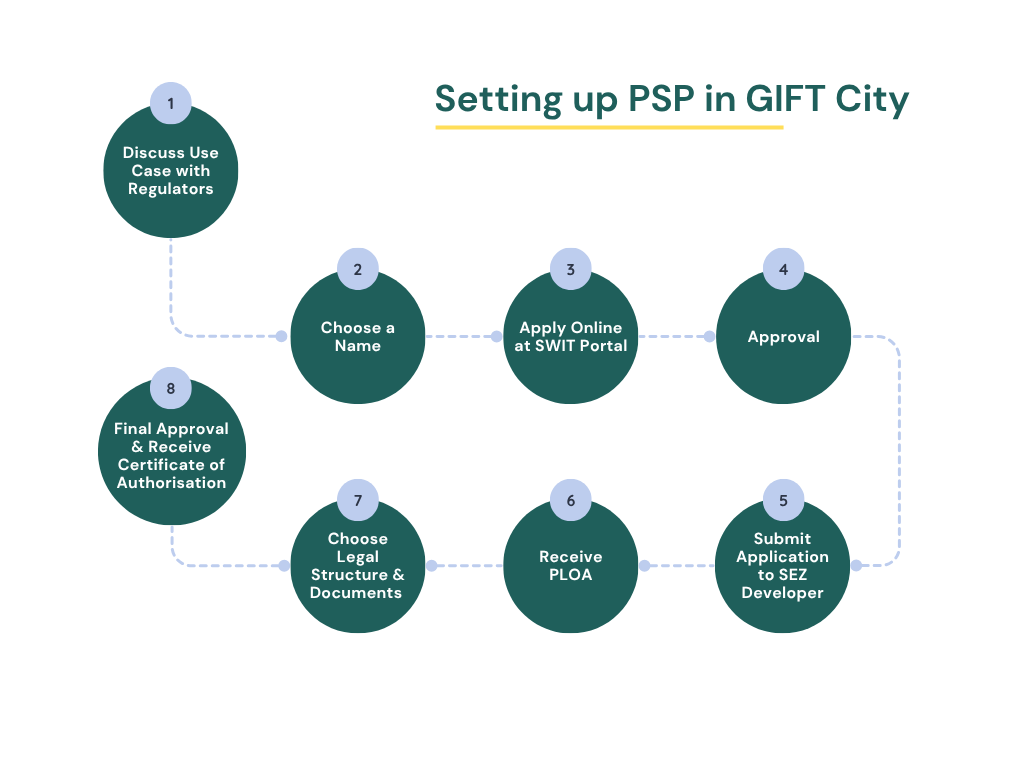

Step-by-Step Guide: How to Start Bullion Trading in GIFT City (2025)

Setting up bullion trade in GIFT City is a structured process, tailored to whether your primary focus is physical bullion import/trade or hedging. Follow these precise steps to establish your presence and begin starting bullion trading through the IIBX ecosystem.

Path 1: For Physical Bullion Traders (Qualified Jewellers & TRQ Holders)

If your aim is to import and trade physical gold and silver, this is your direct route for setting up bullion trading in GIFT City.

- 1. IFSCA Notification & IIBX Membership Application:

- Action: Submit your application and all required documents via the IIBX Membership Portal. This formal application initiates your recognition as a Qualified Jeweller (QJ) or Valid India-UAE TRQ Holder by IFSCA.

- Key Purpose: Official acknowledgment and regulatory approval to commence bullion trade.

- 2. Demat Account Setup with IIDI:

- Action: Open a Demat Account with India International Depository IFSC Limited (IIDI) once your IFSCA notification is received.

- Key Purpose: Essential for holding Bullion Depository Receipts (BDRs) electronically, crucial for seamless trading and settlement.

- 3. Trading and Clearing Account Setup:

- Action: Obtain your Legal Entity Identifier (LEI) and Unique Client Code (UCC), then set up accounts with an IFSCA-registered member.

- Key Purpose: Provides direct access to execute trades and manage clearing on the IIBX platform.

- 4. Submit TRQ Certificate (If Applicable):

- Action: If you are a TRQ holder, submit your valid TRQ Certificate to both IIBX and IIDI.

- Key Purpose: Formalizes your eligibility for concessional customs duties under the Tariff Rate Quota.

- 5. ICE Gate Registration:

- Action: Register your entity on the ICE Gate portal.

- Key Purpose: Mandatory for all customs clearance procedures related to your bullion imports.

- 6. Port Registration:

- Action: Register your TRQ at your designated import port.

- Key Purpose: Ensures proper recognition and processing of your import quota at the point of entry.

- 7. Engage a Custom House Agent (CHA) (Recommended):

- Action: Consider hiring a CHA to assist with customs clearance processes.

- Key Purpose: Streamlines complex import procedures and ensures compliance.

- 8. Connect with an IFSCA Registered Vault Partner:

- Action: Establish a relationship with an authorized vault partner in GIFT City.

- Key Purpose: Secure physical storage, delivery, and management of your imported bullion within SEZs.

Path 2: For Bullion Futures Hedgers

If your goal is to manage price risk exposure to gold and silver, follow this streamlined approach for setting up bullion trading for hedging.

- 1. AD Bank US Dollar Limit Sanction:

- Action: Obtain US Dollar remittance limits approved by your Authorized Dealer (AD) Bank.

- Key Purpose: Required for domestic entities to conduct USD-denominated hedging activities via IIBX Gold and Silver Futures.

- 2. Trading and Clearing Account Setup with IFSCA-Registered Member:

- Action: Once limits are sanctioned, open a Trading and Clearing Account with any IFSCA-registered Bullion Trading/Clearing Member.

- Key Purpose: Provides direct access to the IIBX platform for executing your hedging strategies. (Note: Direct onboarding with IIBX itself is not required for hedgers; membership with a registered entity suffices.)

By following these targeted steps, both physical traders and hedgers can efficiently navigate the process of setting up bullion trade in GIFT City and capitalize on the opportunities within the IIBX ecosystem.

Top Benefits: Importing TRQ Gold through IIBX for Bullion Trading

Setting up bullion trade in GIFT City and leveraging the India International Bullion Exchange (IIBX) offers substantial advantages, particularly for importing Tariff Rate Quota (TRQ) gold under the India-UAE Comprehensive Economic Partnership Agreement (CEPA). These benefits are designed to streamline operations, reduce costs, and enhance efficiency for those starting bullion trading.

Unlocking Efficiency and Cost Savings in Bullion Trade

- Exemption from IGCR Rule: A key benefit for bullion trade in GIFT City is the non-applicability of the Customs (Import of Goods at Concessional Rate of Duty or for Specified End Use) Rules, 2022 (IGCR Rule). As per Notification No. 66/2023-Customs, if the importer and the TRQ holder are the same entity, direct import through IIBX means exemption from this rule.

- Only 5% Customs Duty & No 1% Bond: Importers of TRQ gold through IIBX benefit significantly by paying only 5% customs duty. Crucially, there’s no requirement to block an additional 1% of the Customs Duty value as a bond with Customs, nor do holders need to deposit this 1% with intermediaries. This directly impacts the capital required for setting up bullion trading.

- Seamless TRQ Imports for Qualified Jewellers (QJs): Qualified Jewellers can import their TRQ gold through IIBX without the need for additional re-registration for TRQ, simplifying the process of starting bullion trading.

- Improved Working Capital Management: Eliminating the necessity for upfront payment of customs duty and various premiums allows businesses to manage and allocate their working capital more efficiently across all operations. This is a significant financial advantage for setting up bullion trade.

- Every 30 Minutes Credit of Bullion Depository Receipts (BDRs): IIBX leads globally by crediting BDRs to clients’ Demat accounts within just 30 minutes. This facilitates same-day import of gold/silver into the Domestic Tariff Area (DTA) once BDRs are credited and customs processes are cleared, drastically speeding up bullion trade cycles.

- Flexibility and Convenience in Pricing Lower Lot Sizes: IIBX contracts accommodate purchases as low as 100 grams under the UAEGDTRQ GOLD T+0 contract, and 1 Kg under other quantities. This provides unparalleled flexibility and convenience for diverse trading strategies when setting up bullion trading.

- Low Transaction Charges: IIBX offers highly competitive and very low transaction charges, ensuring a cost-effective environment for all bullion trading activities.

Regulatory Landscape for Bullion Trading in GIFT City (2025)

Setting up bullion trade in GIFT City necessitates a clear understanding of its robust regulatory framework. Adherence to guidelines set by the International Financial Services Centres Authority (IFSCA) and the Ministry of Finance ensures transparent and compliant operations for all participants.

Key Regulations Governing Bullion Trade at IIBX

- IFSCA & Ministry of Finance Oversight: These bodies establish the foundational rules, ensuring a secure and reliable environment for bullion trading within the IFSC.

- Customs Act, 1962 & Recent Amendments: Compliance is crucial with the Customs Act, particularly amendments like Notification No. 66/2023-Customs. This notification clarified that the Customs (Import of Goods at Concessional Rate of Duty or for Specified End Use) Rules, 2022, are not applicable when the importer and TRQ Holder are the same entity, streamlining bullion trade imports.

- India-UAE CEPA & TRQ Gold: The Comprehensive Economic Partnership Agreement (CEPA) with the UAE offers an annual Tariff Rate Quota (TRQ) for gold, providing a 1% customs duty concession. For Fiscal Year 2025-26, the TRQ gold quota stands at 180 tonnes, a significant incentive for setting up bullion trading.

- Updated Import Duty: The import duty on TRQ Gold is set at 5%, effective from July 23rd, 2024, providing a clear cost structure for those starting bullion trading.

Hedging Gold & Silver Price Risk on IIBX

For businesses engaged in bullion trading, managing price volatility is critical. IIBX offers robust mechanisms for hedging gold and silver price risk, allowing domestic residents (excluding individuals) to secure their positions.

IIBX Gold Futures: Specifications & Benefits for Hedgers

IIBX launched Gold Futures on June 21st, 2024, with plans for Silver Futures underway, providing essential tools for setting up bullion trade with effective risk management.

- Purpose: Enables domestic entities with gold/silver price exposure to effectively hedge their risk in USD.

- Key Contract Specifications:

- Trading Unit: 1 Kilogram (Kg)

- Price Quote: In US Dollars per Troy Ounce

- Trading Hours: Monday to Friday, 9:00 Hrs. to 23:30 Hrs. (IST)

- Initial Margin: 6% (+1 ELM) or based on VaR (IMPOR Adjusted), whichever is higher.

- Delivery: Mandatory delivery through Bullion Depository Receipts (BDRs) at IFSCA-registered vaults in GIFT City, based on buyer and seller intention matching.

Bullion Depository Receipts (BDRs) and Efficient Settlement at IIBX

A cornerstone of bullion trade in GIFT City is the innovative Bullion Depository Receipts (BDRs) system operated by IIBX. This electronic representation of physical bullion significantly streamlines transactions and enhances efficiency for setting up bullion trading.

Understanding IIBX’s Advanced Settlement Mechanism

- BDR System Explained: Physical bullion, once deposited in IFSCA-registered vaults, is converted into electronic Bullion Depository Receipts (BDRs). These BDRs facilitate paperless trading and ownership transfer.

- Rapid Settlement Timelines:

- T+0 Settlement Contracts: Market hours operate from 9:00 Hrs. to 18:20 Hrs. (IST), enabling quick transactions.

- BDR Settlement: Occurs with remarkable speed, every 30 minutes, ensuring prompt crediting to Demat accounts.

- Fund Settlement: Activated multiple times daily at 12:15, 15:15, and 19:00 (IST).

- 100% Early Pay-in: This system mandates 100% early pay-in for both funds and securities, further enhancing transaction security and speed.

- Impact on Turnaround Time (TAT): This highly efficient system drastically reduces the overall turnaround time for trade processes, enabling Qualified Jewellers to achieve same-day delivery of bullion post-credit of BDR and customs clearance. This accelerates the entire cycle for starting bullion trading.

Future Outlook: Expanding Bullion Trade in GIFT City Beyond 2025

The trajectory for bullion trade in GIFT City beyond 2025 is exceptionally positive. The combination of a proactive regulatory environment and the innovative framework of IIBX firmly positions it as a formidable global hub for precious metals.

Why GIFT City is Poised for Continued Growth in Bullion Trading

- Proactive Regulatory Environment: The continuous support and adaptive regulations from IFSCA create a stable and attractive ecosystem for investment and setting up bullion trade.

- Innovative IIBX Framework: With ongoing advancements in settlement processes and the planned expansion of product offerings, such as Silver Futures, the IIBX ecosystem is poised for substantial growth and increased market sophistication.

- Strategic Decision for Businesses: Entities seeking to diversify portfolios, hedge against price risks, or directly import bullion will find setting up bullion trade in GIFT City an increasingly strategic and advantageous decision, offering a competitive edge in the global market.