Introduction to Ship Leasing in GIFT City

The ship leasing business in GIFT City is emerging as one of India’s most strategic financial opportunities. Positioned within Gujarat International Finance Tec-City (GIFT IFSC), this model allows global and domestic shipping companies in GIFT City to access tax-efficient leasing structures, foreign currency financing, and a unified regulatory environment under the International Financial Services Centres Authority (IFSCA).

Evolution from Aircraft Leasing to Ship Leasing

- Aircraft leasing success: In 2020, IFSCA first notified aircraft leasing as a financial product. The model attracted global lessors and gave India a presence in a USD 150+ billion aircraft finance market.

- Extension to shipping: Given India’s reliance on maritime trade and high freight outflows, IFSCA extended the framework in 2021–22 to include ship leasing in GIFT City, opening doors for ocean vessels, engines, and related equipment.

- This shift positions GIFT as a maritime financing hub, reducing dependence on foreign jurisdictions such as Singapore and Hong Kong.

Why Promote Operating, Finance, and Hybrid Leases at IFSC

- Operating Lease of Ships – Short/medium-term flexibility, attractive for companies seeking temporary fleet expansion without ownership.

- Finance Lease of Ships – Long-term financing structure where lessee takes economic risk, supporting ship acquisition in India.

- Hybrid Lease Models – Tailored solutions combining operating and finance features, useful for project-based deployments (e.g., contracts under 5 years with purchase option).

Ship Financing Business in India and the World

Global Ship Financing Market

- The global ship financing market is valued at approximately USD 500 billion annually.

- Bank finance dominates this market, often limiting flexibility and increasing exposure to credit cycles.

- Leasing solutions — operating, finance, and hybrid are emerging as attractive alternatives due to:

- Lower upfront capital requirement.

- Flexibility in asset usage and disposal.

- Ability to match lease tenure with project contracts.

Chart: Traditional Ship Finance vs Leasing Models

| Feature | Bank Finance (Traditional) | Ship Leasing (Operating/Finance/Hybrid) |

| Capital Requirement | High upfront | Spread over lease tenure |

| Risk | Bank takes credit risk | Shared between lessor & lessee |

| Flexibility | Rigid repayment | Adjustable (buy/return option) |

India’s Shipping Landscape

India is a critical player in the global shipping industry:

- Global ranking: Ranked 17th in shipping volume.

- Infrastructure: Coastline of 7,517 km with 12 major and 205 minor ports.

- Trade dependency:

- 95% of India’s goods trade by volume and 70% by value is carried via sea transport.

- Reliance on maritime trade makes shipping finance vital for economic resilience.

- Freight outflow: Indian companies pay approximately USD 75 billion annually to foreign shipping companies for seaborne freight.

- This highlights a financing gap and opportunity for shipping business in GIFT City to retain value within India.

Table: India’s Maritime Trade at a Glance

| Parameter | Data |

| Global Shipping Rank | 17 |

| Coastline | 7,517 km |

| Major Ports | 12 |

| Minor Ports | 205 |

| Trade by Volume via Sea | ~95% |

| Trade by Value via Sea | ~70% |

| Annual Freight Paid Abroad | ~USD 75B |

Charter Types in Ship Leasing

Ship leasing in India and globally often operates under charter agreements that define how vessels are provided:

- Bareboat Charter (BBC)

- Only the vessel is provided.

- No crew, fuel, or services included.

- Lessee assumes full responsibility for operations and expenses.

- Useful for companies that want control over operations and crew management.

- Time/Voyage Charter

- Vessel provided along with crew and services (fuel, maintenance, logistics).

- Lessee pays for usage based on time or specific voyage.

- Reduces operational responsibility for the lessee, making it popular for short-term contracts.

Legal & Regulatory Framework for Ship Leasing in GIFT IFSC

The legal framework for ship leasing in GIFT City is built on the strong foundation of the International Financial Services Centres Authority Act, 2019 (IFSCA Act). This framework ensures global investors, financiers, and shipping companies in GIFT City operate under a clear, tax-efficient, and internationally benchmarked regime.

Key Notifications

- MoF Notification No. S.O.5199(E), dated Dec 14, 2021

- Recognized operating lease of ships, including hybrid leases, as a financial product under the IFSCA Act, 2019.

- This step enabled leasing companies in GIFT City to structure both operating lease of ships and finance lease of ships with regulatory backing.

- October 2020: Aircraft Leasing Notification

- Aircraft leasing was first notified as a financial product.

- Its strong response created a successful precedent that was later extended to the shipping business in GIFT.

These notifications made ship leasing a legally recognized financial activity, giving lessors the ability to structure leases in foreign currency and under globally acceptable standards.

SAFAL Committee (October 2021)

- Committee on Ship Acquisition, Financing and Leasing (SAFAL) was formed to address India’s shipping finance gap.

- The committee’s October 2021 report recommended:

- Immediate notification of vessel leasing as a financial product.

- Inclusion of both operating lease of ships and finance lease of ships within IFSC activity scope.

- Allowing hybrid lease models to serve project-specific needs.

- Implementation: Acting on SAFAL’s recommendations, IFSCA formally notified ship leasing in GIFT City as a financial product, making India competitive with maritime hubs such as Singapore and Hong Kong.

Governing Regulations

The regulatory backbone for ship leasing in GIFT IFSC comes from the IFSCA (Finance Company) Regulations, 2021 and the Ship Leasing Framework, 2022 as amended from time to time.

IFSCA (Finance Company) Regulations, 2021

- Applicable to entities registered as Finance Companies (FCs) or Finance Units (FUs).

- Cover registration requirements, prudential norms, governance standards, reporting obligations, and KYC/AML compliance.

- Classification of leasing activities:

- Operating Lease of Ships → treated as a permitted non-core activity.

- Finance Lease of Ships (including hybrid structures) → classified as a permitted core activity.

Ship Leasing Framework – May 18, 2022

- Introduced a dedicated framework for ship leasing entities.

- Mandatory registration of every ship lessor with IFSCA.

- Required a separate license for asset management support services, ensuring operational transparency.

Capital Requirements:

- Minimum USD 200,000 for an entity engaged in operating lease of ships.

- Minimum USD 3 million for entities undertaking finance lease of ships.

Types of Ship Leasing in GIFT IFSC

The ship leasing business in GIFT City offers multiple leasing structures to suit the diverse needs of shipping companies in GIFT City and global maritime operators. The International Financial Services Centres Authority (IFSCA) allows three key models of ship leasing operating lease, finance lease, and hybrid lease each catering to different risk appetites, capital requirements, and business objectives.

Operating Lease of Ships

- Definition: A short to medium-term lease where the lessor retains ownership and the vessel is returned at the end of the contract.

- Use Case:

- Ideal for companies that require fleet flexibility without long-term commitments.

- Popular among shipping businesses handling seasonal or project-based cargo demand.

- Key Advantage: Off-balance sheet treatment for lessees, improving capital efficiency.

- Capital Requirement in GIFT IFSC: Minimum USD 200,000 for entities offering operating leases.

Finance Lease of Ships

- Definition: A long-term lease where ownership and economic risks transfer to the lessee.

- Use Case:

- Suitable for shipping companies that want to acquire vessels through structured financing.

- Helps reduce upfront capex while maintaining long-term operational control.

- Key Advantage: Functions almost like a ship purchase with financing, while providing tax and financing benefits of GIFT IFSC.

- Capital Requirement in GIFT IFSC: Minimum USD 3 million for finance leasing entities.

Hybrid Lease of Ships

- Definition: A blend of operating and finance leases, tailored to unique business needs.

- Example: A shipping firm that needs a larger vessel for a project lasting less than 5 years may opt for a hybrid lease with higher initial rentals and an option to purchase the vessel at maturity.

- Use Case:

- Companies executing medium-term contracts where standard lease models are inefficient.

- Allows flexibility for both lessee and lessor in risk and reward allocation.

- Capital Requirement in GIFT IFSC: Case-specific, generally aligned with finance lease thresholds.

Lease Comparison Table

| Parameter | Operating Lease | Finance Lease | Hybrid Lease |

| Tenure | Short/Medium term | Long-term | Flexible / Project-based |

| Ownership | Lessor | Lessee (eventually) | Option to purchase at maturity |

| Risk/Reward | Lessor | Lessee | Shared / Negotiated |

| Capital Requirement | USD 200,000 | USD 3 million | Case-specific (generally ≥ finance lease) |

Key Takeaways:

- Operating lease of ships in GIFT IFSC = flexibility and low capital requirement.

- Finance lease of ships = long-term financing and eventual ownership.

- Hybrid lease of ships = custom solutions for project-specific or medium-term needs.

- These structures strengthen maritime financing in GIFT City, helping India reduce its reliance on foreign shipping hubs while attracting global shipping companies in GIFT City.

Why GIFT City for Ship Leasing? Key Advantages

Choosing GIFT City for ship leasing provides global and domestic players with unmatched financial and operational advantages. The International Financial Services Centres Authority (IFSCA) has created a framework that combines tax incentives, regulatory ease, and global competitiveness, making it a strong alternative to established hubs such as Singapore, Hong Kong, and Dubai.

Tax Incentives for Ship Leasing in GIFT City

- 100% profit-linked tax holiday: Available for any 10 consecutive years out of the first 15 years of operations.

- No Withholding Tax (WHT): On interest, lease rentals, or royalty payments made to non-residents, provided operations commence within specified timelines.

- GST benefits: Leasing transactions structured as supplies by IFSC units to non resident customers / other units within IFSC qualify as zero-rated supply, reducing indirect tax burden.

- Stamp duty waiver: The Government of Gujarat has granted a waiver in relation to stamp duty on vessel acquisition and related activities until March 2027.

Table: Snapshot of Tax Incentives in GIFT IFSC

| Incentive | Benefit | Timeline / Condition |

| Profit-linked Tax Holiday | 100% deduction for 10 consecutive years | Within first 15 years of operations |

| WHT Exemption | No WHT on lease rentals, interest, royalties | If commenced before cut-off date |

| GST | Zero-rated supply on IFSC leasing | Subject to LUT filing |

| Stamp Duty | Waiver on vessel acquisition | Valid up to March 2027 |

Regulatory Ease

- Single regulatory authority: IFSCA consolidates approvals, eliminating multi-agency overlaps common in domestic shipping finance.

- Streamlined compliance: Simplified corporate governance, reporting, and operational processes for shipping companies in GIFT City.

Global Competitiveness

- Entities can raise capital in foreign currency, offering flexibility to global lessors and financiers.

- Cost-effective structure compared to leasing in Singapore or Hong Kong, enhancing India’s appeal for maritime financing in GIFT City.

Strategic Location

- Located in Gujarat, near India’s largest ports, GIFT City acts as a gateway to India’s 7,517 km coastline.

- Positioned to serve both domestic shipping needs and international maritime trade routes.

Benchmarking Against Global Hubs

- Lower costs of setting up and running leasing operations compared to Singapore, Hong Kong, or Dubai.

- Advantageous time zone and regulatory incentives make GIFT IFSC a compelling alternative for ship leasing in GIFT City.

Benefits of a Ship Lessor Registered in GIFT IFSC

Registering as a ship lessor in GIFT City unlocks direct tax, indirect tax, and operational benefits, ensuring long-term profitability and compliance ease.

Income Tax Benefits

- 100% profit-linked deduction: Available for 10 years within the first 15 years.

- MAT/AMT at 9%: Applies to IFSC entities, unless opting for the new corporate tax regime.

- No WHT on payments to non-residents: Includes lease rentals, royalties, and interest.

- Capital gains benefit: 100% deduction on capital gains from transfer of ships or SPVs in IFSC owning ships to a non resident.

GST Benefits

- Zero-rated supply: Supplies by IFSC entities to non-resident customers and units within IFSC is treated as exports; no GST liability if LUT is furnished.

- IGST application: Leasing of ships to Domestic Tariff Area (DTA) customers subject to IGST.

- Exemption from reverse charge: Imports for authorized operations by IFSC units are exempt from reverse charge under GST.

Other Benefits

- Stamp duty waiver: On vessel acquisition up to March 2027.

- Corporate governance relaxations:

- Fewer mandatory board meetings.

- Flexibility in subsidiary creation.

- Reduced compliance burden compared to domestic companies.

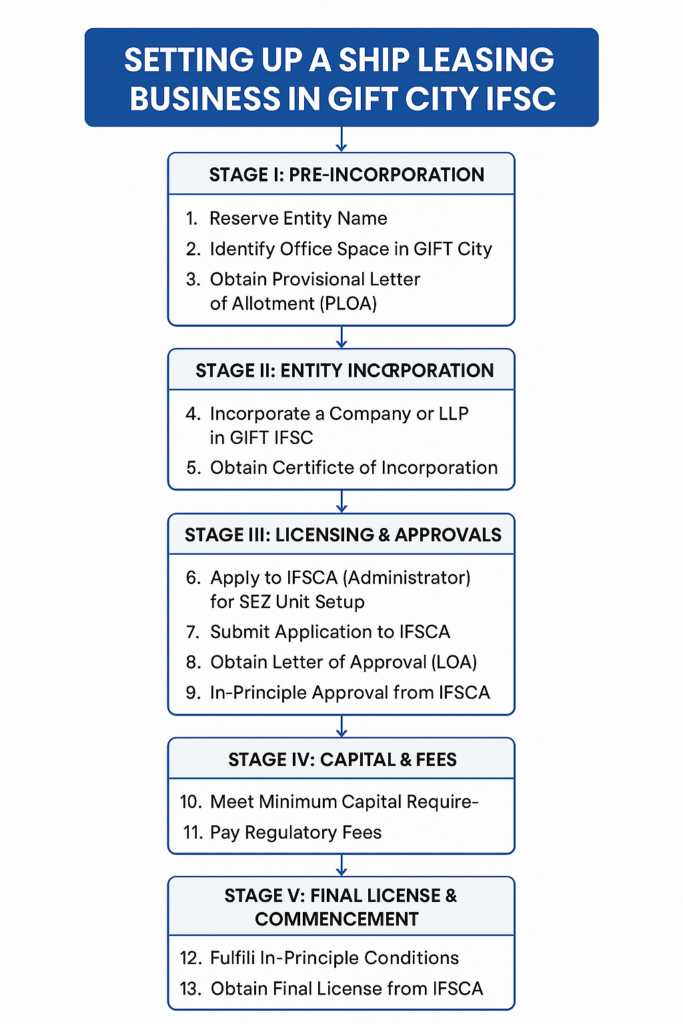

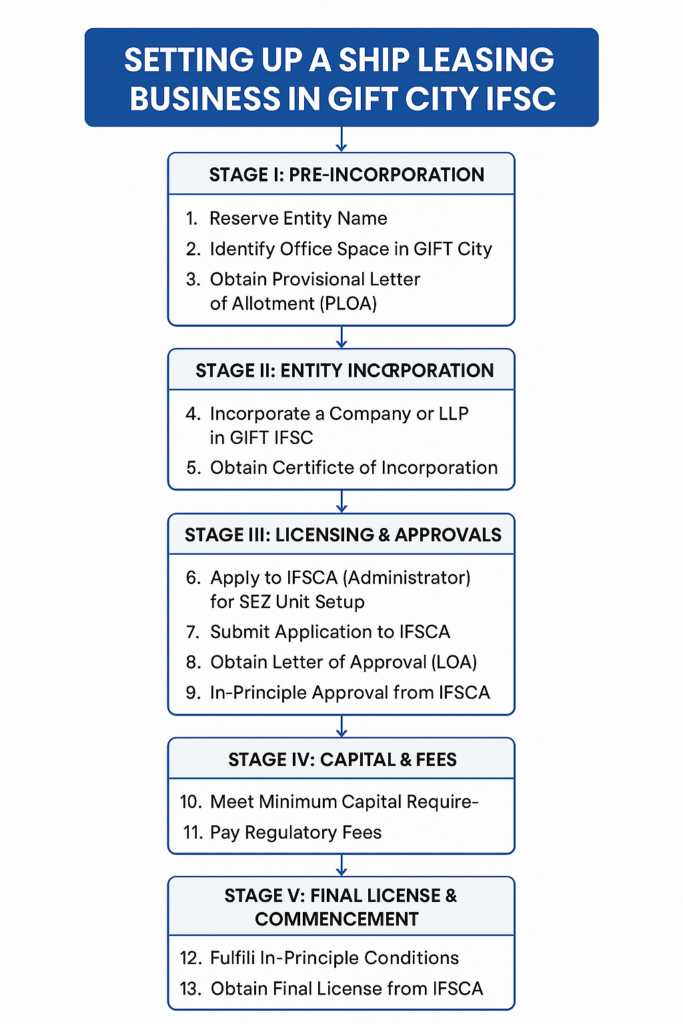

Setting Up a Ship Leasing Business in GIFT City IFSC: Step-by-Step Guide

Establishing a ship leasing company in GIFT City IFSC is a structured process governed by the IFSCA (Finance Company) Regulations, 2021 and the Ship Leasing Framework, 2022. By following the prescribed steps, both Indian and foreign shipping companies can begin operations efficiently while benefiting from tax and regulatory incentives.

Stage I — Pre-Incorporation

- Reserve Entity Name

Secure the desired legal name for the company or LLP that will undertake ship leasing. - Identify Office Space in GIFT City IFSC/SEZ

Finalize physical office premises within GIFT City’s IFSC/SEZ area. - Obtain Provisional Letter of Allotment (PLOA)

Get the PLOA from the GIFT City developer for the designated office space.

Stage II — Entity Incorporation

- Incorporate an Entity in GIFT IFSC

Form a company or unit in GIFT IFSC. You can structure it as a:

- Finance Company (FC), or

- Finance Unit (FU) under IFSCA regulations.

Foreign ownership is permitted, making GIFT IFSC attractive for international lessors.

- Obtain Certificate of Incorporation

Receive the formal Certificate of Incorporation (company/LLP).

Stage III — Licensing & Approvals

- Apply to Development Commissioner / IFSCA (Administrator)

File the initial application to set up an SEZ Unit (functions now handled by the IFSCA Administrator) through SWIT portal. - Apply for Registration with IFSCA

Submit application on SWIT portal under:

- Finance Company Regulations, 2021, and

- Ship Leasing Framework, 2022.

Your IFSCA application must include:

- Detailed business plan for leasing activities.

- Promoters’ fit & proper credentials.

- Risk management policies and compliance strategy (AML/KYC).

- Obtain SEZ/IFSCA Letter of Approval (LOA)

Receive authorization to operate as a ship leasing unit within GIFT IFSC. - Receive In-Principle Approval from IFSCA

Conditional approval specifying requirements (e.g., minimum capital infusion, operational readiness) to be fulfilled before final registration.

Stage IV — Capital & Fees

- Meet IFSCA Minimum Capital Requirements

IFSCA mandates thresholds by lease type:

| Lease Type | Minimum Capital Requirement | Activity Classification |

| Operating Lease of Ships | USD 200,000 | Non-core activity |

| Finance Lease of Ships | USD 3,000,000 | Core activity |

| Hybrid Lease of Ships | Case-specific (≥ USD 3M baseline) | Core activity (blend of operating & finance) |

- Pay IFSCA and SEZ Fees

After capital compliance, pay applicable charges:

- IFSCA fees: Application, registration, and annual charges.

- SEZ fees: One-time registration and annual recurring fees.

These payments formalize regulatory compliance and authorize the entity to operate within GIFT IFSC.

Stage V — Final License, Commencement & Ongoing Compliance

- Comply with In-Principle Conditions

Fulfill all prerequisites and conditions in the In-Principle approval (capital, policies, readiness). - Obtain Final IFSCA License / Certificate of Registration

IFSCA issues the final approval to officially commence the regulated ship leasing business. - Commence Operations

Your license allows you to:

- Undertake operating lease of ships,

- Provide finance lease of ships, or

- Structure hybrid lease models for project-specific needs.

You can transact with Indian Domestic Tariff Area (DTA) clients as well as international shipping operators.

- Post-Setup & Ongoing Compliances

Adhere to continuing IFSCA obligations, including reporting and AML/KYC standards.

Financing Models in Ship Leasing

The success of the ship leasing business in GIFT City depends not just on legal frameworks but also on how shipping companies in GIFT City finance their vessels. Globally, ship financing is dominated by banks, but leasing and alternative capital structures are increasingly important. GIFT IFSC offers access to multiple maritime financing in GIFT City options — from traditional bank loans to innovative hybrid and cross-border solutions.

Bank Finance (Traditional)

- Globally, 80%+ of ship financing still comes from banks.

- Typically structured as secured loans backed by ship mortgages.

- Pros:

- Familiar structure for lenders and borrowers.

- Lower cost of borrowing when credit is strong.

- Cons:

- Rigid repayment schedules.

- Exposure to credit cycles and lender concentration risks.

- In India, reliance on overseas banks has led to higher costs and dependency, creating demand for alternative leasing models in GIFT City.

Operating Lease Funding

- Funding model used for operating lease of ships.

- Sources of funds:

- Debt financing (domestic/foreign loans).

- Securitization of lease receivables (pooling leases into tradable securities).

- Advantage:

- Enables lessors to recycle capital quickly.

- Lessees benefit from flexibility without ownership risks.

- Particularly relevant for short-to-medium term shipping contracts in India.

Finance Lease Funding

- Designed for finance lease of ships, where ownership and risk eventually pass to the lessee.

- Funding tools include:

- Long-term project financing (structured loans).

- Corporate or infrastructure bonds backed by ship assets.

- Advantage:

- Spreads cost of vessel acquisition over long periods.

- Attractive for shipping businesses planning fleet expansion.

- In GIFT City, finance leases can be funded in foreign currencies, giving global lessors an edge.

Hybrid Lease Funding

- Combines features of both operating and finance lease models.

- Structured to support project-based shipping needs (e.g., 3–5 year contracts).

- May involve:

- Higher upfront rentals.

- Option-to-purchase clause at maturity.

- Benefits both lessors and lessees through shared risk allocation.

- Useful for companies with specialized cargo or offshore projects.

Maritime Financing in GIFT City

One of the biggest advantages of setting up in GIFT IFSC is access to global financing markets:

- External Commercial Borrowings (ECBs): Companies can borrow in foreign currency at competitive rates.

- Foreign Currency Loans: Access to USD, EUR, and other currencies avoids INR depreciation risks.

- Syndicated Loans: Participation of multiple global banks spreads risk and lowers cost.

- Structured Maritime Finance: Combines debt, leasing, and securitization to support large-scale vessel acquisitions.

Table: Financing Options for Ship Leasing in GIFT City

| Financing Model | Instruments Used | Best Suited For |

| Bank Finance | Ship mortgage-backed loans | Traditional, long-term owners |

| Operating Lease Funding | Debt + securitization | Flexible short-term charters |

| Finance Lease Funding | Bonds + project finance | Fleet expansion, long-term use |

| Hybrid Lease Funding | Custom contracts, purchase options | Project-based shipping |

| GIFT City Maritime Financing | ECBs, foreign loans, syndications | Global lessors, cross-border trade |

Regulatory Fees for Ship Leasing Entities in GIFT IFSC

Establishing a ship leasing business in GIFT City requires payment of specific regulatory fees to the International Financial Services Centres Authority (IFSCA) and the Special Economic Zone (SEZ) authorities. These charges are transparent and globally competitive, making GIFT City an attractive destination for shipping companies in GIFT City.

IFSCA Fees for Ship Leasing Entities

IFSCA charges vary depending on whether the entity is engaged in an operating lease of ships or a finance lease of ships.

| Particulars | Operating Lease | Finance Lease |

| Application Fee (one-time) | USD 1,000 | USD 1,000 |

| Registration Fee (one-time) | USD 12,500 | USD 12,500 |

| Annual Fee (recurring) | USD 5,000 | USD 12,500 |

Operating lease entities enjoy lower recurring fees, while finance lease entities have higher annual costs due to larger capital requirements and higher-risk structures.

SEZ Fees for Ship Leasing Entities

Apart from IFSCA, SEZ authorities levy their own one-time and recurring charges:

| Particulars | Amount (INR) |

| Application Fee (one-time) | ₹5,000 |

| Registration Fee (one-time) | ₹25,000 |

| Annual Fee (recurring) | ₹5,000 |

Compared to global shipping hubs, SEZ fees in GIFT City are minimal, ensuring cost competitiveness for both domestic and international lessors.

Market Opportunity: Shipping Business in GIFT City

The shipping business in GIFT City is strategically positioned to capitalize on India’s growing maritime economy and global shipping trends. With strong regulatory support and competitive cost structures, GIFT IFSC can bridge India’s long-standing financing gaps.

India’s Maritime Dependency and Freight Outflow

- India pays approximately USD 75 billion annually to foreign shipping companies for seaborne freight.

- This massive outflow represents a significant opportunity for ship leasing in GIFT City, where domestic lessors can capture part of this market.

Maritime Economy Significance

- 95% of India’s trade by volume and 70% by value is carried through sea routes.

- With a coastline of 7,517 km, 12 major ports, and 205 minor ports, India’s shipping infrastructure demands financing solutions aligned with global practices.

Global Ship Leasing Market Potential

- The global ship leasing market is valued at USD 30–35 billion, and GIFT City is aiming to capture a share of this growing segment.

- By positioning itself as a maritime financing hub, GIFT IFSC reduces reliance on traditional shipping hubs like Singapore and Hong Kong.

Ancillary Opportunities in GIFT City

Beyond ship leasing itself, GIFT City provides scope for a complete maritime ecosystem:

- Ship management services – operations, maintenance, and compliance.

- Marine insurance – specialized risk products tailored for leased vessels.

- Crew and logistics services – supporting the operational side of leasing.

- Port-linked financing – enabling integrated trade and logistics support.

Table: Opportunity Landscape for Shipping Business in GIFT City

| Opportunity Area | Market Insight |

| Freight Retention | Reduce USD 75B paid abroad annually |

| Global Leasing | USD 30–35B market ripe for India’s entry |

| Trade Dependency | 95% trade volume by sea |

| Ancillary Services | Ship management, insurance, crew, ports |

The market opportunity for ship leasing in GIFT City is immense. With USD 75 billion in annual freight payments, a USD 30–35 billion global ship leasing market, and India’s heavy reliance on maritime trade, GIFT IFSC is set to become a strategic hub. Combined with low regulatory fees and strong tax incentives, this ecosystem attracts both global and domestic shipping companies in GIFT City, making it a cornerstone of India’s maritime financing future.

Risks and Challenges in Ship Leasing from GIFT City

While the ship leasing business in GIFT City presents strong opportunities, investors and shipping companies in GIFT City must also evaluate key risks. Addressing these challenges is critical for positioning GIFT IFSC as a sustainable maritime financing hub.

Currency Risks (INR vs USD)

- Most global ship leasing transactions are denominated in USD or EUR.

- Indian lessees earning in INR may face forex volatility, impacting repayment ability.

- Hedging solutions are available within GIFT IFSC, but costs may reduce profitability for both lessors and lessees.

Regulatory Maturity Stage

- The ship leasing in GIFT City framework is still relatively new (notified in 2021–22).

- Regulatory processes, though streamlined under IFSCA, are still evolving.

- Investors may face uncertainties until more standardized legal precedents are established.

Global Competition from Maritime Hubs

- Established hubs like Singapore, Hong Kong, and Dubai DIFC already dominate global maritime financing.

- These hubs benefit from decades of regulatory clarity and market trust.

- GIFT City must offer lower costs, tax arbitrage, and faster approvals to remain competitive.

Need for Maritime Arbitration in GIFT

- Disputes in ship leasing are often international, requiring specialized maritime arbitration.

- Currently, most Indian shipping disputes are referred to Singapore or London arbitration centers.

- Building a maritime arbitration hub in GIFT IFSC is essential to enhance credibility and reduce reliance on foreign jurisdictions.

Mitigating currency risks, strengthening regulations, and developing in-house dispute resolution are critical steps for scaling ship leasing in GIFT City globally.

Case Studies & Early Movers in GIFT IFSC

The best way to evaluate GIFT’s potential in ship leasing is by studying precedents and global benchmarks.

Aircraft Leasing Precedent in GIFT

- In October 2020, IFSCA first notified aircraft leasing as a financial product.

- Within months, major lessors and financiers set up entities in GIFT IFSC.

- This success paved the way for ship leasing in GIFT City, proving that India can replicate international leasing models.

First Approvals for Ship Leasing Entities

- Following the Ship Leasing Framework (May 2022), the first approvals were granted to ship lessors in GIFT IFSC.

- These early movers benefit from:

- Tax holidays (10 years out of 15).

- No WHT on foreign payments.

- Stamp duty waivers until 2027.

- Their presence demonstrates market confidence and validates GIFT City as a maritime financing hub.

Singapore’s Maritime Leasing Model vs India’s Framework

- Singapore:

- Globally recognized for ship finance and leasing.

- Strong maritime arbitration system, government-backed incentives, and access to global capital.

- India (GIFT IFSC):

- Competitive tax incentives (100% profit-linked deductions, GST benefits).

- Lower operating and registration fees compared to Singapore.

- Still developing ecosystem support (e.g., maritime arbitration, ancillary services).

Table: Singapore vs GIFT City – Ship Leasing Framework

| Parameter | Singapore | GIFT City (India) |

| Tax Incentives | Corporate tax concessions | 100% profit-linked holiday (10 of 15 years) |

| Arbitration | Mature maritime arbitration centers | Developing capacity |

| Fees | Higher regulatory costs | Lower fees (USD 1,000–12,500) |

| Market Maturity | Established global hub | Emerging but growing |

Future Outlook of Ship Leasing in GIFT City

The future of ship leasing in GIFT City is strongly aligned with India’s broader maritime and economic goals. With government backing, regulatory clarity, and rising demand for localized financing, GIFT IFSC is positioned to become a global hub for ship leasing and maritime financing by the end of this decade.

Alignment with Maritime India Vision 2030

- Maritime India Vision (MIV) 2030 outlines investments of over USD 82 billion to modernize ports, logistics, and shipping infrastructure.

- GIFT City is expected to play a strategic role in supporting these initiatives by:

- Providing finance lease of ships for fleet expansion.

- Offering operating lease of ships for project-specific needs.

- Facilitating hybrid lease structures for specialized maritime contracts.

- By integrating financing with infrastructure, GIFT IFSC bridges the gap between India’s shipping demand and global leasing practices.

Projected Growth of Ship Leasing Entities by 2030

- With India ranked 17th globally in shipping volume, there is vast scope to expand domestic leasing capacity.

- By 2030, experts project:

- Dozens of new ship leasing companies in GIFT City, including global lessors and Indian shipping firms.

- Lease volumes worth billions of USD annually, capturing a share of the USD 30–35 billion global ship leasing market.

- Growth will be driven by:

- Rising demand for bulk cargo carriers and container vessels.

- Expansion of India’s port capacity under Sagarmala and MIV 2030.

- Increased use of foreign currency loans and syndicated financing through GIFT IFSC.

Table: Projected Growth Indicators for Ship Leasing in GIFT City (by 2030)

| Indicator | 2025 (Current) | 2030 (Projected) |

| Ship Leasing Companies in GIFT IFSC | Early-stage approvals | 20–30 entities |

| Lease Volume | <$1B | $8–10B annually |

| Share of Global Ship Leasing Market | <1% | 5–7% |

| India’s Freight Outflow | $75B annually | Reduction by 10–15% |

Government Backing to Reduce Freight Outflow

- India pays nearly USD 75 billion annually to foreign shipping companies for freight.

- The government’s goal is to retain a significant share of this spending domestically by building capacity at GIFT IFSC.

- Policy initiatives supporting this goal include:

- Tax incentives (10-year profit-linked holiday).

- Stamp duty waivers till 2027.

- Regulatory frameworks for operating, finance, and hybrid leases.

- By 2030, local leasing platforms at GIFT City could help reduce India’s freight dependency by 10–15%, directly boosting the national economy.

GIFT as an Integrated Hub for Shipping + Financing

GIFT IFSC is not only about leasing ships — it is about building a holistic maritime ecosystem:

- Ship Leasing & Financing – Access to global capital markets, ECBs, and foreign currency loans.

- Ancillary Services – Marine insurance, ship management, crew services, and port-linked logistics.

- Arbitration & Dispute Resolution – Future establishment of maritime arbitration centers in GIFT City to reduce reliance on Singapore or London.

- Integration with Ports – As India expands its 12 major and 205 minor ports, GIFT City provides the financing backbone to support growth.

By 2030, ship leasing in GIFT City is projected to grow into a multi-billion-dollar industry, reduce India’s freight outflow, and position the country as a global leader in maritime financing, on par with Singapore and Hong Kong.